Global advertising growth is forecast for 3.3% growth in 2023, with inflation driving the slightly lower-than-forecast increase. But, what does 2024 bring, especially as broadcast media in the U.S. anticipates another big political-dollar windfall?

Dentsu provided its analysis on Wednesday (5/31), and the data is positive for not only 2024, but for 2025, on a global level.

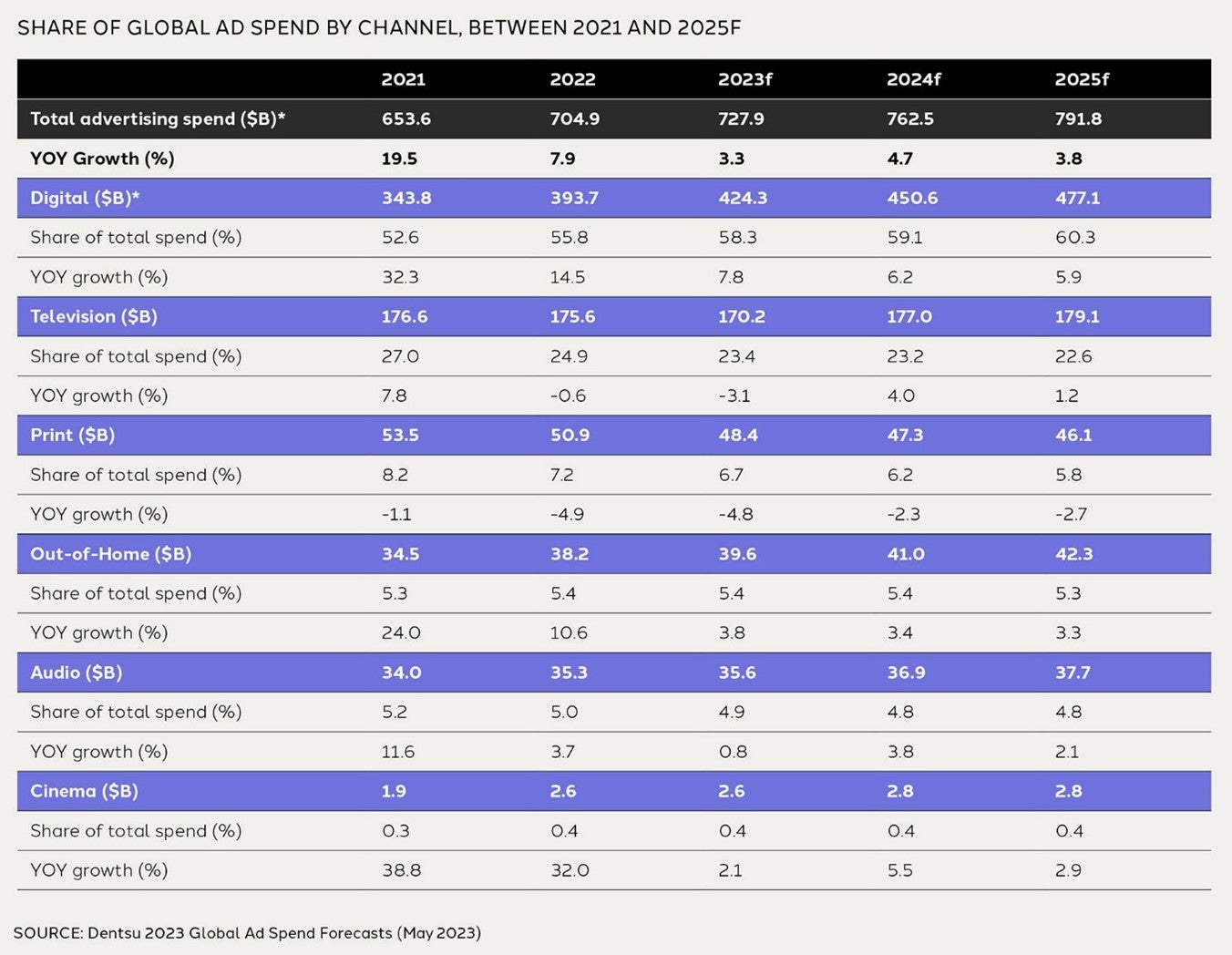

Advertising investment is forecast to grow by 3.3% globally in 2023, according to freshly released information from Dentsu. Overall, an anticipated $727.9 billion will be spent worldwide by the end of the year, as Dentsu released its mid-year “reforecast” of its twice-yearly Global Ad Spend Forecasts report.

While continued growth is the overall message from Dentsu, the 3.3% growth forecast has been adjusted “marginally downward” from the 3.5% predicted in the December 2022 report. Why? Those pesky “macroeconomic factors” are the key factor, echoing explanations from broadcast media chief executives on their quarterly earnings calls as to why profits are still a challenge for some companies.

Dentsu’s report shows growth driven by media price inflation, rather than increased advertising volume; advertising spend at constant prices is expected to decline slightly, with –0.6% reduction year on year.

Looking past 2023, the global outlook as forecasted by Dentsu specialists “is more positive,” with spend set to accelerate faster in 2024; it is forecast to grow by 4.7% to $762.5 billion in 2024. “This boosted ad spend is being driven by major sporting and societal focal events such as UEFA Euro Championship and the U.S. presidential election,” Dentsu notes, taking two major ad-generation engines into account.

Dentsu is also predicting further 3.8% growth into 2025, it shares.

CHANGING CHANNELS?

Emerging digital categories are expected to continue to experience high growth in 2023, such as retail media (18.0%) and connected TV (15.2%). “The preference for programmatic buying is also on the up, with advertising spend transacted programmatically forecast to increase by 14.4%, to reach 71.4% share of digital spend in 2023,” Dentsu says.

From a channel perspective, the 2023 dentsu Global Ad Spend Forecasts outlook is now showing a mixed forecast with perhaps, most notably, a drop within the television ad spend for the year. “TV ad spend is now expected to fall by 3.1%, totaling $170.2 billion by end of year, which in itself appears to be a temporary blip in its typically upward spending trend, with positive growth returning for 2024 onwards,” Dentsu says.

Except for print ad spending, which continues its decline (-4.8%), the other media channels are holding ground, with incremental year on year increases for Out-of-Home (+3.8%), cinema (+2.1%) and audio (+0.8%).