Four years after splitting Fox into a separate company, News Corporation is seeing struggles with its print assets.

It was a good Q3 for the company’s remaining cable network programming … in Australia. The segment saw adjusted revenue of 1%, to $125 million, thanks to higher advertising revenue.

The company’s digital real estate services segment also posted a strong quarter, with 10% growth when looking at adjusted revenues.

But, overall adjusted revenue was off by 2%, as its core News and Information Services segment — the main assets it has in the U.S. –continued to deal with print advertising challenges that are crippling the entire newspaper industry.

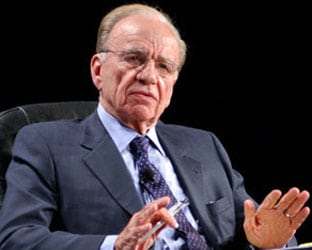

In prepared comments made Monday after the closing bell on Wall Street, News Corp. CEO Robert Thomson said, “While the quarter presented some obvious challenges, particularly in print advertising and the weakness of the Pound Sterling, our revenue were relatively stable, underscoring the strength and scale of our portfolio and shift to digital.”

“Stable” depends on your viewpoint.

Total adjusted revenue slipped by 2%, to $1.96 billion. Total adjusted segment EBITDA slid by 11%, to $152 million.

While the News and Information Services segment is to blame, Cable Network Programming EBITDA dropped by 8%, to $20 million.

Increased programming rights costs were a key culprit for the dip, the company said.

News Corp print assets include The Wall Street Journal, which is cutting staff and shrinking the size of the daily print publication, and the New York Post tabloid.

News Corp split from 21st Century Fox in June 2012, in a move similar to how Tronc and Tribune Media split their broadcast and newspaper assets.