A “deluge of ads” from expanded legalized sports betting and the return of midterm political ad spending in 2022 are expected to aid U.S. broadcasters’ rebound from the

pandemic. But, that is inclusive of Television. How is radio shaping up?

Justin Nielson, a Senior Research Analyst for broadcast media at S&P Global Market Intelligence’s Kagan group is poised to deliver much insight on Tuesday (11/15) at Forecast 2022 in New York.

Ahead of the event, which you can still register for here, Nielsen offered some top-line takeaways for where Radio revenues will likely be in a year. Nielson’s key insight: Radio station business is expected to bounce back from the pandemic-induced recession, but with an important caveat.

Ahead of the event, which you can still register for here, Nielsen offered some top-line takeaways for where Radio revenues will likely be in a year. Nielson’s key insight: Radio station business is expected to bounce back from the pandemic-induced recession, but with an important caveat.

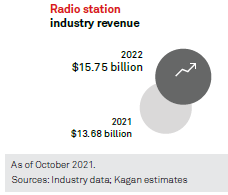

“Expected growth of 6.2% to $15.75 billion in 2022 is still only a partial recovery given the deep 23% decline in 2020, with revenues falling to $13.68 billion,” Nielson says. “Radio ads are predominantly local and focused on the auto, retail, travel and entertainment categories, which were heavily impacted by the advertising pullback.”

Radio also must compete with “multiple” streaming and on-demand options for music and talk and is “hindered” by the new hybrid or permanent work-from-home economy, which has greatly reduced commuting hours during prime in-car radio time.

This counters Nielsen data (no relation to Justin Nielson) that suggest radio’s consumption recovery is all but complete from the depths of pandemic-induced quarantines.

Despite those headwinds, Nielson of Kagan points to radio’s “lower ad cost, local audience and relatively high return on investment compared to other media.”

This, Nielson says, should help Radio maintain its share of the U.S. advertising market.