TORONTO — Shares in Corus Entertainment Inc. tumbled by 25.3% to a new all-time low of $0.68 CAD on Friday, as investors reacted to an announcement from the Toronto-based media company that it has amended its credit facilities by increasing its total debt to cash flow ratio through August 31, 2024. Mandatory quarterly repayments of the Term Facility are re-introduced. Certain conditions related to the use of proceeds on asset disposals are changed and additional restrictions on distributions are introduced, the company said.

The announcement from Corus came concurrent to its fiscal Q4 and year-end 2023 results, which weren’t pretty. “Fourth quarter results reflect ongoing weakness in the advertising economy, further impacted by more recent distortions resulting from the WGA and SAG-AFTRA strikes that persisted much longer than anticipated,” said President/CEO Doug Murphy.

He continued, “We are focused on what we can control as we navigate through these challenges. We will prudently redirect capital from dividends to debt repayment. Our intense pursuit of efficiencies and improved productivity is resulting in significant expense reductions as we streamline our operating model and evolve our business into a multi-platform aggregator of premium video with leading cross platform monetization capabilities. Corus will benefit from a more normalized content supply in the quarters ahead with an improved cost structure as we await a concurrent improvement in the advertising economy.”

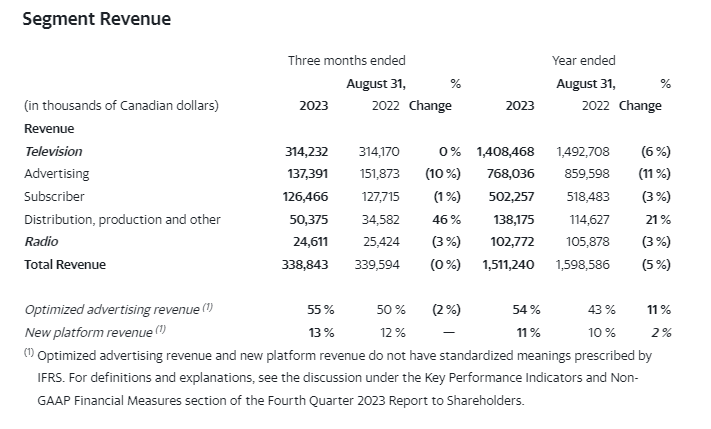

In fiscal Q4, television revenue was flat at $314.23 million CAD, moving from $314.17 million CAD, as segment profit slid to $49.774 million CAD from $59.018 million CAD. Radio revenue declined by 3% to $24.611 million CAD, from $25.42 million CAD, with segment profit actually rising to $2.98 million CAD, from $1.73 million CAD.

Importantly, Free Cash Flow was down to $31.654 million CAD, from $44.71 million CAD.

What’s the outlook from Corus? Not good.

The company expects its television advertising revenue in the first quarter of fiscal 2024 to decline in the range of 15%-20% from the same period of fiscal 2023.

Furthermore, the amortization of program rights is expected to decline by a similar range along with the further implementation of additional cost management initiatives.

Corus has also suspended its dividend and intends to redirect the use of free cash flow from dividends on Class A and Class B shares to debt repayment, adding to the shareholder revolt, as some 7.19 million shares were traded on the TSX in Friday’s trading. Average volume for CJR-B is roughly 604,300 shares.

“While the Company continues to expect improvement in the macro-environment and the normalization of program supply over the medium term, visibility remains limited at this time,” it said.

Corus’ brands include the Global broadcast TV network; Pluto TV in Canada; cable networks in Canada including HGTV, Food Network and Disney Channel; and a group of broadcast radio stations that include CILQ “Q107” in Toronto, CHQR in Calgary; CJOB in Winnipeg and stations in such markets as London, Ont.