The largest pay-TV providers in the U.S., representing about 95% of the market, continued to lose video subscribers in the second quarter of 2018.

But, is the tide of cord-cutters slowing? Leichtman Research Group findings suggest that’s starting to happen, but not for the biggest MVPDs.

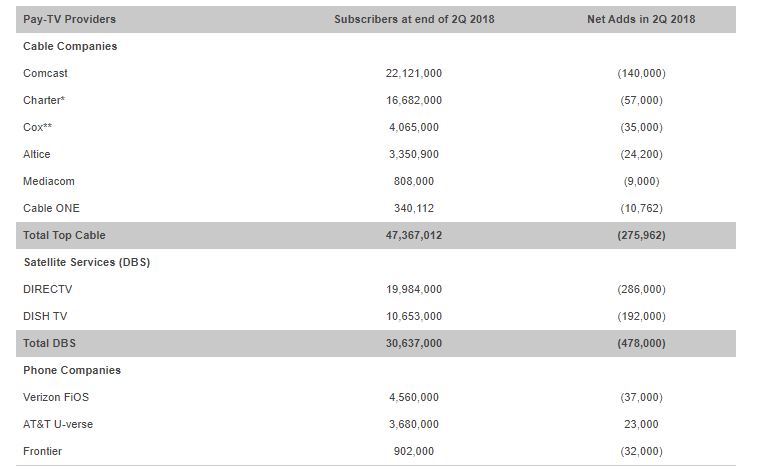

According to new data released by Leichtman, the top pay-TV providers lost roughly 415,000 net video subscribers in Q2.

This compares to a pro-forma loss of roughly 660,000 subscribers in the same period of 2017.

However, a closer look at the data reveals that the largest MVPDs in the U.S. continue to struggle with customer retention. The top six cable companies lost about 275,000 video subscribers in Q2, a rise from a loss of roughly 190,000 subscribers in the second quarter of 2017.

At the same time, the loss of satellite TV service subscribers — namely those paying for DirecTV or DISH Network service — continued to plague the DBS companies. Leichtman found that satellite TV services lost about 480,000 subscribers in Q2 2018, compared to a loss of about 470,000 subscribers in Q2 2017.

It was a record quarter for net losses for DBS providers, fueled by net losses at not DISH — in a major dispute right now with Univision Communications — but rival DirecTV. Net losses for the AT&T-owned DBS provider were higher in Q2 than in any previous quarter, Leichtman notes.

What continues to grow are the “skinny bundle” alternatives to more costly DBS and MVPD services. IP-delivered services including Sling TV and DirecTV NOW added some 385,000 subscribers in Q2, compared to about 270,000 net adds in the second quarter of 2017.

The top pay-TV providers now account for about 91.3 million subscribers, with the top six cable companies having 47.4 million video subscribers, satellite TV services 30.6 million subscribers, the top telephone companies 9.1 million subscribers, and the top Internet-delivered pay-TV services 4.2 million subscribers.