It’s been stated for decades that the Hispanic community is not just a key demographic segment, but a dynamic force shaping the future of consumer behavior and brand engagement.

Thus, as the media landscape in 2023 reveals intriguing shifts for all consumers, viewing trends among Hispanics suggest, in the words of Nielsen SVP of Diverse Insights & Intelligence Stacie de Armas, “there’s a profound opportunity for brands to align with Hispanic consumers’ consumption preferences, tailoring content and advertising strategies to meet the community’s needs and values.”

And, just like non-Latinos, U.S. Hispanics are “undeniably drawn to streaming” as Spanish- dominant Hispanics continue to embrace broadcast television.

Hispanics are also avid audio consumers, with Radio an essential component.

The 20-page report, available via download by clicking here, is more than a reflection of the current state of media consumption for Hispanics, de Armas says. “The insights here provide an in-depth understanding of the unique authenticity signals and credibility markers that drive the Hispanic community’s choices with media and brands. Our goal is to equip brands, agencies and publishers with strategies to effectively engage the community, mindful of the complexities impacting their brand loyalty, trust and overall media engagement.”

The digital shift: Embracing new viewing trends

One of the biggest takeaways from the report shows that, on average, U.S. Hispanic adults spend 8 hours and 41 minutes per day with media, based on Nielsen National TV Panel data from Q1 2023.

“Like all audiences, Hispanics spend the most time with television, but their engagement with TV differs from that of the general population,” de Armas shares.

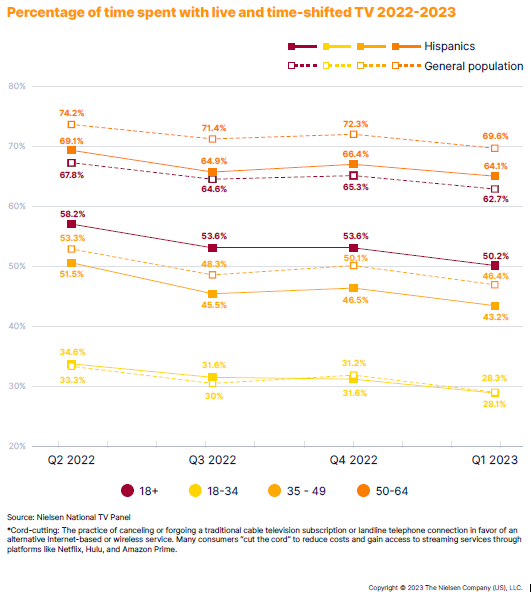

There’s a big reason for this: Hispanic audiences, especially younger Latinos, remain at the forefront of cord-cutting, a trend Nielsen sees reflected in the amount of time spent with traditional TV programming. In Q1 2023, among Hispanic adults 18+, live and time-shifted viewing accounted for slightly more than half of their total time with TV, 22% less than the general population.

This is even more pronounced for Hispanics 18-34, who spend just 28.1% of their time with live and time-shifted TV.

But, the biggest takeaway from Nielsen’s de Armas is that, in Q1, Hispanic adults age 18-49 spent the majority of total time with TV with content they accessed from the internet.

In fact, U.S. Hispanics spent more than 30 billion minutes with connected TV in the first quarter of 2023.

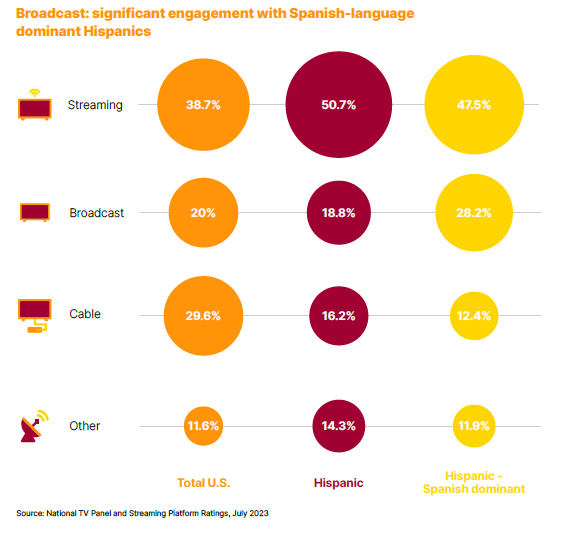

De Armas comments, “With so much choice available, these services have the ability to provide diverse, representative and accessible content that Hispanic audiences are looking for, thereby earning their engagement over other options. Traditional broadcast TV continues to command significant engagement among Hispanics who primarily speak Spanish—highlighting the enduring role of broadcast media as not just a source of entertainment, but also a vital cultural touchstone for Spanish-dominant Latinos.”

The streaming story for U.S. Latinos mirrors that for the total population.

As of May 2023, only 42% of Hispanic TV homes were traditional cable homes, down from 49% a year earlier, based on data from the Nielsen National TV Panel in May 2023. “As engagement with cable has declined, accessing TV content through an internet connection has increased,” de Armas says.

As of May 2023, 27% of Hispanic homes accessed TV content using a broadband internet connection, which is up nearly 20% in just one year.

Sube, Sube …

The report from Nielsen also shows that Radio reaches 94% of Hispanic adults, according to March 2023 Nielsen RADAR data. That’s higher than Radio’s 90% reach across the general population.

Importantly, Radio’s reach among the 18-49 demo is just as high, and is also at 94%.

“The importance of Spanish-language media is very clear through the lens of radio, as Regional Mexican and Spanish Contemporary are the top two formats among Hispanic adults 18 and older,” de Armas says.

But, could there be an opportunity to provide Spanish-language radio consumers more than just music?

When it comes to news, Nielsen finds that Hispanics are 13% more likely than the general population to listen to podcasts. “Much like streaming video, the podcast landscape offers significantly more choice than traditional channels, and more than 3.5 million Hispanics are avid podcast news listeners,” Nielsen concludes.

![hispanic]](https://rbr.com/wp-content/uploads/hispanic.png)