The fiscal second quarter 2023 financial results for The Walt Disney Co. were released following Wednesday’s Closing Bell on Wall Street. How did the owner of ABC and ESPN perform in the three-month period?

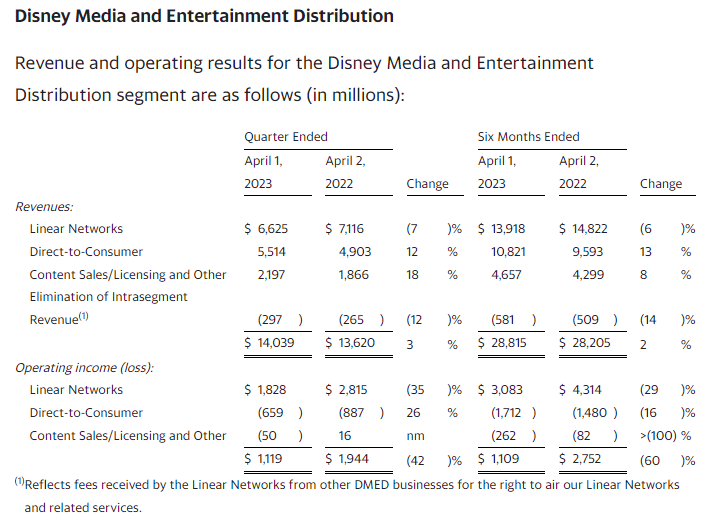

Disney Media and Entertainment Distribution revenue climbed 3% from last year, moving to $14.04 billion from $13.62 billion. Operating income, however, slid by 42%, moving to $1.119 billion from $1.944 billion.

Breaking down the quarter, the dip in operating income is explained by the following:

Linear Networks revenues for the quarter decreased 7% to $6.6 billion, and operating income decreased 35% to $1.8 billion.

The following table provides further detail of Linear Networks results (in millions):

| Quarter Ended | Change | |||||||

| April 1, 2023 |

April 2, 2022 |

|||||||

| Supplemental revenue detail | ||||||||

| Domestic Channels | $ | 5,573 | $ | 5,826 | (4 | )% | ||

| International Channels | 1,052 | 1,290 | (18 | )% | ||||

| $ | 6,625 | $ | 7,116 | (7 | )% | |||

| Supplemental operating income detail | ||||||||

| Domestic Channels | $ | 1,568 | $ | 2,349 | (33 | )% | ||

| International Channels | 85 | 245 | (65 | )% | ||||

| Equity in the income of investees | 175 | 221 | (21 | )% | ||||

| $ | 1,828 | $ | 2,815 | (35 | )% | |||

Domestic Channels revenues for the quarter decreased 4% to $5.6 billion, and operating income decreased 33% to $1.6 billion. The decrease in operating income was due to lower results at both Cable and Broadcasting.

The decrease at Cable was due to higher sports programming and production costs and, to a lesser extent, lower affiliate and advertising revenue. The increase in sports programming and production costs was attributable to higher College Football Playoffs (CFP) and NFL programming costs and, to a lesser extent, contractual rate increases for NBA programming and an increase in production costs. The increase in costs for CFP programming was due to the timing of games relative to our fiscal periods as the current quarter included three CFP games compared to one game in the prior-year quarter. Higher NFL rights costs were due to the timing of costs under our new agreement compared to the prior NFL agreement. Lower affiliate revenue resulted from a decline in subscribers, partially offset by higher contractual rates. Advertising revenue decreased because of lower impressions at the non-sports channels, partially offset by the timing of the CFP.

The decrease at Broadcasting was due to lower results at ABC and the owned television stations, both of which reflected lower advertising revenue. The decrease at ABC was driven by lower average viewership, while the decrease at the owned television stations was due to lower rates.

A PLUS FOR DIGITAL?

Direct-to-Consumer revenue for the fiscal second quarter increased 12%, to $5.5 billion, lowering its operating loss by $200 million to $700 million.

The decrease in operating loss was due to improved results at Disney+ and ESPN+, which were partially offset by lower operating income at Hulu.

The improvement at Disney+ was due to higher subscription revenue and a decrease in marketing costs, partially offset by higher programming and production costs and, to a lesser extent, increased technology costs.

On an overall basis, according to Bloomberg, Disney slightly fell short of expectations.

- Revenue: $21.82 billion (equal to $21.82 billion expected)

- Adj. earnings per share (EPS): $0.93 versus $0.94 expected

- Total Disney+ subscribers: 157.8 million versus 163.1 million expected

- Disney Parks, Experiences and Products revenue: $7.78 billion versus $7.67 billion expected