When it comes to Wall Street analyses from investment houses, MoffettNathanson has emerged as one of the most influential when it comes to publicly traded broadcast media companies. As such, the assessment of Paramount Global from Senior Analysts Robert Fishman and Michael Nathanson and its most recent quarterly earnings report is noteworthy.

Why? Even though the TV Media arm enjoyed 5% EBITDA growth in the fourth quarter, it was down 7% for the full year. That’s nothing, however, compared to their Free Cash Flow concerns.

2022 was a challenging year for Paramount.

That’s how Fishman and Nathanson open their investor note on Paramount Global, which starts with the positives: Paramount+ subscribers grew to 56 million, capped off by a strong finish of nearly 10 million net additions in the fourth quarter.

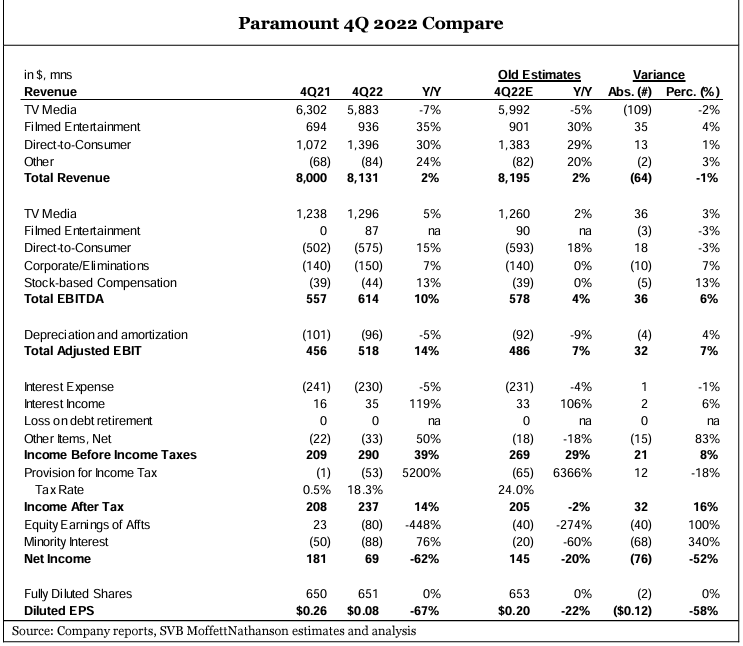

Then, there’s the TV Media performance in Q4.

However, Fishman and Nathanson continue to believe media investors should first focus on “the true measure of operating performance.” That would be Free Cash Flow.

For Paramount, Free Cash Flow was down by a half-billion dollars in 2022, compared to 2021.

The FCF forecast for 2023 is bleak, with a further decline anticipated before a return to positive free cash flow in 2024.

What happened? “The main driver of negative free cash flow and pressure on total company EBITDA has been the pivot to Paramount+,” the MoffettNathanson analysts note. “While subscriber growth has been better than expected, it has clearly come at a significant cost to the company’s overall financial picture. Although Direct-to-Consumer losses will improve in 2024, the scale of the improvement is vague.”

While the consolidation of longtime premium cable TV brand Showtime into Paramount+ is viewed as a plus, due to the resulting cost savings of roughly $700 million, Fishman and Nathanson question how much is true cash savings versus future programming and other costs avoidance of limited bottom-line impact.

Then, there is the television business. As D2C subscribers, revenue and losses climb, Fishman and Nathanson question “the sustainability” of the TV Media segment. “Even as management guides to a moderate improvement in affiliate fee growth in the first quarter, we question the sustainability of the current -3% levels given cord cutting will likely accelerate through the year.” In addition, the analysts believe Paramount’s “leakage” of premium content such as the NFL to Paramount+ “weakens the company’s hand as it enters affiliate renewals, further weighing on future growth.”

Helped by an expected improvement in the ad market in the back half of 2023, MoffettNathanson expects Paramount’s TV Media EBITDA to similarly be back-half weighted, improving from double-digit declines in the first half of 2023 to low single digit declines in the last six months of the year.

“Putting it all together, we project 2023 will be an even tougher year than 2022,” Fishman and Nathanson conclude.

This leads the analysts back to the free cash flow dilemma facing Paramount. MoffettNathanson now projects a free cash flow loss of $750 million in 2023 and a “significant swing back” to positive $225 million in 2024. The cash flow improvement should be helped by more muted growth of cash content spending, although future programming strategies could impact that.

In conclusion, Fishman and Nathanson state, “Paramount is still far from reaching the other side of its ongoing DTC transition. The road remains tough, and the destination’s promise remains murky.”