In February 2023, the Walt Disney Company — parent of ABC Owned Stations and ESPN — revealed that, “to restore creativity to the center” of its business, Disney would reorganize its media and entertainment businesses.

These were previously reported in one segment, Disney Media and Entertainment Distribution. As a result of the reorganization, Q4 2023 financials will be reported in two segments. A resulting media frenzy in reporting ESPN’s declining fortunes commenced. But, how healthy are the ABC assets?

It’s still not crystal clear.

That answer may still not be wholly clear, as Disney on Wednesday notified the Securities and Exchange Commission that under its new segment reporting, the Entertainment segment will receive an “intersegment allocation” of revenues from the consumer products business, which is included in the Experiences segment (renamed from Disney Parks, Experiences and Products).

“This revenue allocation, which is now consistent with the approach taken prior to our last segment reporting changes in 2020, is meant to reflect royalties on merchandise licensing revenues generated on intellectual property (IP) created by the Entertainment segment, more consistent with certain of our industry peers and reflective of the value this IP brings to our consumer products business,” Disney said.

The company also confirmed that its Entertainment segment “generally encompasses” the company’s non-sports focused global film, television and direct-to-consumer (DTC) video streaming content production and distribution activities.

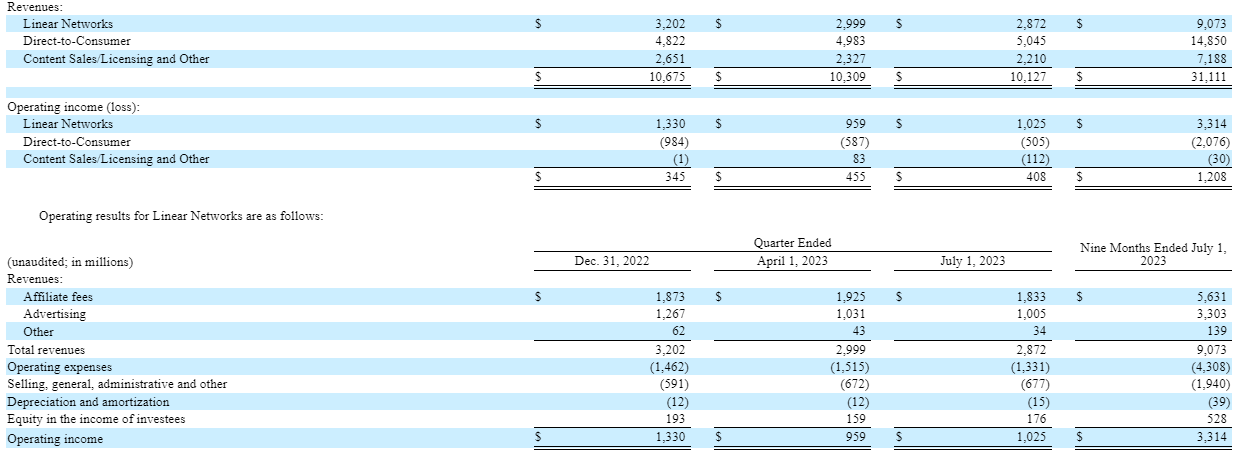

And, within that, are the Linear Networks — comprised of the ABC Television Network; Disney, Freeform, FX and National Geographic (owned 73% by the Company) branded television channels; and eight owned ABC television stations.

There’s also Disney, Fox, FX, NatGeo and Star outside of the U.S., included in its Linear Networks revenue, as well as Disney’s 50% equity investment in A+E Television Networks , which operates cable channels including A&E, HISTORY and Lifetime.

That’s a lot of consolidated revenue. So, how are the ABC television stations performing?

We still don’t know, as “recast segment results” for the nine-month period ending July 1, 2023 shifted Sports — namely, ESPN-associated holding — into its own line item.

And, as has been widely reported, Sports revenue across the first three quarters of fiscal 2023 came in at $13.2 billion, with segment operating income ending up at $1.21 billion.

Putting a lens solely on fiscal Q3, Sports revenue totaled $4.335 billion, with operating income of $854 million.

While that provides a potential buyer of ESPN a gauge of its performance, which is diminished compared to past years, investors remain somewhat in the dark as to how stations such as WABC-7 in New York — which opted to fire its veteran morning news anchor over a reported “hot mic” incident, leaving it vulnerable to increased competition — are truly performing from a revenue perspective.

For the nine-month period ending July 1, Linear Networks revenue totaled $9.07 billion as operating income came in at $3.31 billion.

That’s actually a positive achievement, as the Direct-to-Consumer segment — which includes Disney+ — experienced revenue of $14.85 billion yet logged a $2.08 billion operating loss through fiscal Q3 ’23 due to exceptional expenses.

Disney did break down the Linear Networks revenue somewhat by offering line items for “Affiliate Fees” and “Advertising.” As shown below, the story here — like with peers in the broadcast TV arena — is that fees from retransmission accords are now bringing in more dollars than core advertising.

A GLIMPSE OF OTA TV’s PERFORMANCE?

MoffettNathanson senior analysts Robert Fishman and Michael Nathanson were among several Wall Street observers who focused on the ESPN fiscal details.

They were surprised that the newly reported ESPN Domestic EBITDA declined “by only 4%” in the first nine months of fiscal 2023. “One of the big overhangs on the stock this year has been the surprising drop in Linear Networks profits with U.S. Networks expected to decline by $1 billion, or -15%, in FY 2023,” they write. “Given ESPN represents the largest piece of this segment, we had made the assumption that it was largely to blame. So consider us surprised.”

One factor is ESPN+. “After making ESPN+ adjustments, we can back into ESPN linear EBIT still down in the mid-to-high teens year-to-date,” the MoffettNathanson analysts say.

And, by paring down or dropping sports rights, ESPN revenue is perhaps more stable than in recent quarters.

Then, there is the matter of affiliate fees versus core advertising dollars. Fishman and Nathanson point out that sports advertising for Disney through its fiscal Q3 is down 12% while Entertainment Linear Networks advertising is down 14%. However, the sports dollars are largely impacted by Star India. “We continue to see India (including Star India and Disney+ Hotstar) as a key initiative for CEO Bob Iger to fix through either a Joint Venture or outright sale,” Fishman and Nathanson say.

Lastly, “an opportunity for additional cost cutting” at the Entertainment Linear Networks exists, to help improve profitability and “revenue headwinds” as fiscal 2024 awaits.

As of 10:48am Eastern, Disney shares were off 43 cents to $84.25, a price last seen in March 2013.

![Cumulus’s Houston Head Gets Expanded Role As RVP Alex Cadelago [Photo: Al Torres Photography/2017; Cumulus Media]](https://rbr.com/wp-content/uploads/Alex-Cadelago-1-1-e1718979040116-218x150.jpg)