The future of Viacom is looking bright for President/CEO Bob Bakish.

The owner of pay-TV brands such as MTV, Nickelodeon, CMT and BET and Paramount Pictures saw net earnings fall by 12% in fiscal Q1 2017, to $396 million ($1.00) from $449 million ($1.13).

When adjusted for one-time gains and costs, diluted EPS came in at $1.04 a share, down from $1.18.

While that’s a year-over-year dip, the results were much higher than what 14 analysts surveyed by Zacks Investment Research expected — 83 cents per share.

Overall revenue improved by 5%, to $3.32 billion. This surpassed the forecast by seven analysts surveyed by Zacks of $3.2 billion.

Analysts surveyed by FactSet for MarketWatch expect Viacom’s fiscal Q1 2017 revenue to hit $3.18 billion.

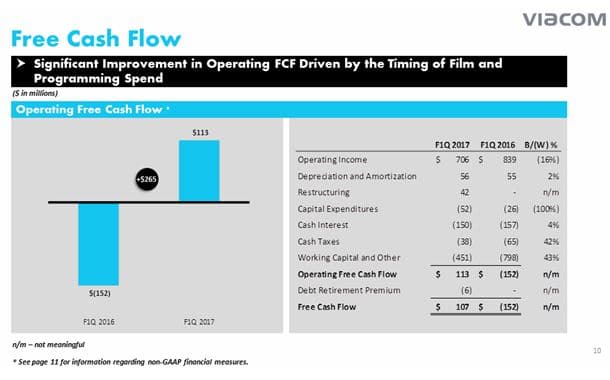

In prepared comments distributed early Thursday morning, Bakish said, “Viacom’s first quarter results reflect improvement in our core businesses, with increases in revenues and operating cash flow, continued strong international performance, including initial contributions from the acquisition of [Argentina-based] Telefe, and a return to positive growth in affiliate revenues.”

He added that Viacom is already benefiting from changes made early in the second quarter and seeing “green shoots” in its strongest businesses, “as well as those that are poised for a turnaround.”

On that note, Bakish on Thursday shared a strategy “that will enable Viacom to realize the full potential of its premier global portfolio of entertainment brands.”

Building on Viacom’s leading domestic and growing international footprint, this strategy “will expand the depth and reach of our flagship brands across multiple platforms and around the world, while also providing for more competitive differentiation and increased adaptability for our business overall,” he said. “There is much work to be done, but we are confident we have the plan and people to take our brands to greater heights and build a bright future for our company.”

Breaking out the results, Viacom’s Media Networks fell 7% in fiscal Q1, to $987 million from $1.06 billion in the first fiscal quarter of 2016. Domestic revenue remained flat at $2.06 billion, while international revenues grew 5%, to $534 million.

Affiliate revenues improved 2% to $1.14 billion, with domestic affiliate revenue increasing 2%, to $985 million. The increase in domestic revenues reflects rate increases and the impact of SVOD and other Over-The-Top agreements, partially offset by a modest decline in subscribers.

Advertising revenues declined 2%, to $1.29 billion, as a 1% increase in international advertising revenues was more than offset by a 3% decrease in domestic advertising revenues. The decline in domestic advertising revenues reflects softer ratings at certain networks, but were positively impacted by higher pricing, Viacom said.