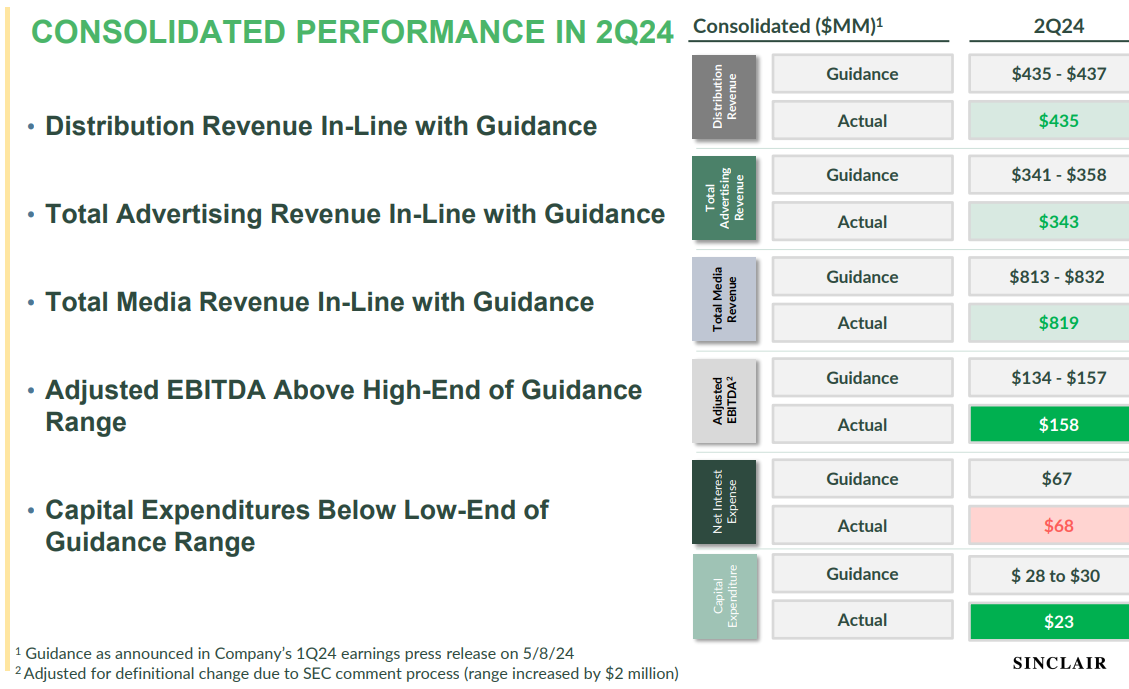

As RBR+TVBR reached its 4:30pm Eastern editorial deadlines on Wednesday, Sinclair Inc. executives were poised to begin their second quarter earnings call for analysts and investors. Ahead of that call, the company shared its Q2 2024 earnings presentation, in which it shared it exceeded its Adjusted EBITDA guidance as total ad revenue came at the low end of its guidance.

An illustration of how Sinclair’s Q2 fared appears below:

The 18-page PDF presentation is largely a marketing piece, demonstrating how Sinclair is a “diversified broadcast leader with broad distribution” even as it has over-the-air stations on the market for interested buyers.

The company also played up how it offers “local news trusted within a highly polarized U.S. market”; Sinclair’s local news has taken a conservative viewpoint across many of its markets.

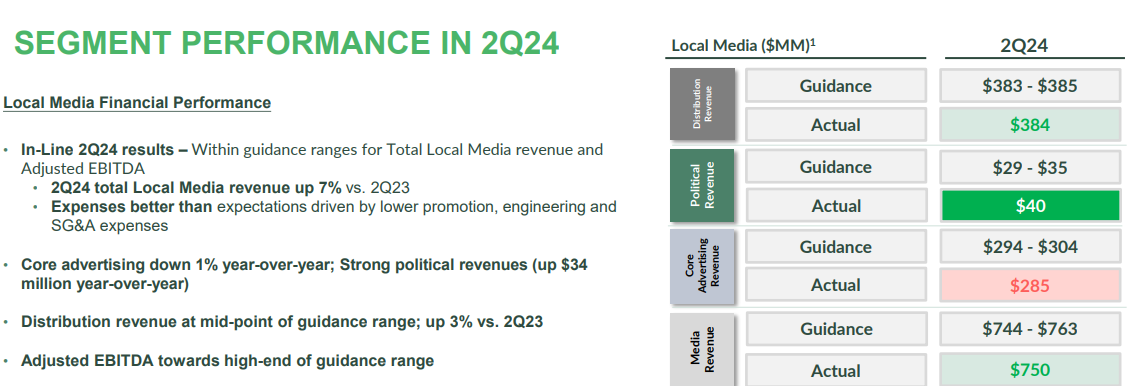

These traits helped Local Media for Sinclair in Q2, as adjusted EBITDA of $163 million came in at the high end of the company’s guidance range:

The presentation also contains Q3 guidance details, and adjusted EBITDA is anticipated to come in between $229 million and $254 million.

That’s up 58% to 75% vs. pro forma Q3 2024 adjusted EBITDA of $145 million.

So, what’s the bottom line on Q2 for Sinclair?

Total revenue improved to $829 million from $768 million, but this fell short of the $836.51 million consensus estimate fueled by input from 7 analysts polled by Yahoo! Finance. The low estimate was $831 million.

Net income attributable to Sinclair of $17 million ($0.27 per share) was seen, a swing from a Q2 2023 net loss of $89 million (-$1.38 per share). This easily beat the consensus EPS estimate of -$0.13.

“As we enter the second half of the year, we are buoyed by strong momentum and multiple cash flow drivers,” CEO Chris Ripley said in prepared remarks. “Political advertising revenue is on track to be our largest ever, with expected double-digit growth rates over the 2020 presidential election year. Coupled with growth in distribution revenues, and continued strength in core advertising trends, we are well-positioned for a robust finish to the year.”

With the release of the Q2 2024 numbers, the Sinclair Board of Directors declared a quarterly cash dividend of $0.25 per share on the company’s Class A and Class B common stock. The dividend is payable on September 13 to shareholders of record at the close of business on August 30, 2024.

Sinclair shares were up by nearly 6% in after-market trading on Wednesday upon the release of the Q2 2024 results.