Updated at 5:40pm Eastern

The E.W. Scripps Co.‘s executive leadership team will be waiting until Friday morning to dissect its just-released second quarter 2024 earnings report, giving investors and analysts time to digest the data and seek answers as to why the company missed the consensus revenue estimate of 5 analysts in a significant way.

The company led by President/CEO Adam Symson reported operating revenues of $573.63 million in Q2, declining from $582.84 million a year ago.

The range of the five analysts polled by Yahoo! Finance was for revenue to come in between $582 million and $591.5 million.

Meanwhile, two analysts offered earnings per share estimates, putting the range between -$0.06 and +$0.03.

A net loss attributable to shareholders was seen again, albeit a much smaller one, shrinking to $13 million (-$0.15 per share), from $682.41 million (-$8.10) in Q2 2023.

Adjusted EBITDA fell to $99.96 million from $120.92 million.

In early after-market trading on Thursday, Nasdaq GlobalSelect-traded “SSP” was down by 1.7% to $2.91.

Among some of the “business notes” shared by Scripps ahead of the 9:30am Eastern call on Friday is that the company “now believes its 2024 Local Media election-year political advertising revenue will reach record levels, with even the low end of the new range, $270-$290 million, above any previous year.”

Previously, the company had given a range of $240-$270 million.

The increased outlook, Scripps says, is being driven largely by U.S. Senate races in Montana and Ohio as well as “controversial ballot issues” in several states. “There also could be upside captured in the new dynamics of the race for president,” Scripps says.

Elaborating on the political performance, Scripps head Symson said that in Q2 Local Media political advertising revenue came in “much stronger than expected at $28 million,” driving 40% growth in the first half of the year over the same period of 2020. This created some local ad displacement

Meanwhile, progress is being made in regard to the planned sale of the Bounce digital multicast network, which Scripps seeks to divest. Scripps acquired the African American-targeted over-the-air offering in 2017 through its Katz Networks purchase.

Then, there is Scripps Networks’ national advertising upfront sales season, which is winding down with volume increases in the low single digit percent range over last year, “driven largely by the success of the company’s women’s sports strategy.”

Wrapping up his prepared comments ahead of the Friday call, Symson said, “As we move through the second half of the year, this management team continues to see a clear path

to significant debt paydown by year end. Our expectations for segment profit are driven by the robust political advertising revenue outlook. We also are exercising prudent expense management, and we are progressing nicely with our efforts to sell the Bounce TV network and some non-strategic real estate assets. All of these factors give us confidence we can bring down our leverage significantly going into 2025.”

A LOCAL MEDIA POLITICAL PUMP

The infusion of political dollars helped Scripps Local Media division see a 3.6% increase in revenue, to $364.93 million, in Q2.

- Core advertising revenue decreased 6.9% to $139.12 million, due in part to displacement from political advertising

- Political revenue was $28.15 million, compared to $3.85 million in the prior-year quarter, a non-election year

- Distribution revenue was $194.19 million, compared to $195.27 million in the prior-year quarter

Segment expenses grew by 2.1% to $277 million in the quarter, due to efforts tied to the NHL’s forthcoming Utah club and the Las Vegas Golden Knights.

Segment profit was $88.13 million, compared to $81.02 million in the year-ago quarter.

Scripps Networks revenue was $208.72 million, down 9.7% from the prior-year quarter. With flat segment expenses of $171 million, segment profit was $37.75 million — declining from $60.34 million in Q2 2023.

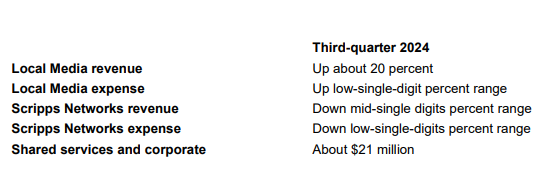

Lastly, third quarter guidance was offered by Scripps.