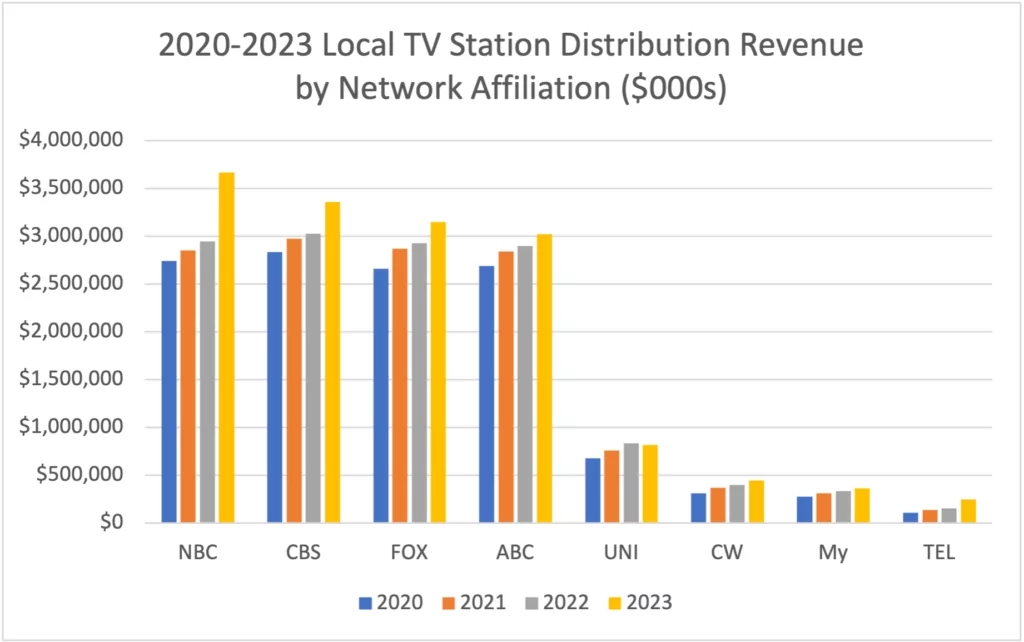

New estimates from BIA Advisory Services indicate that local broadcast television stations enjoyed a whopping 22.5% increase in distribution revenue between 2020 and 2023, rising from $12.3 billion from MVPDs and vMVPDs to $15.1 billion.

BIA broke down the data by television networks, and stations affiliated with NBC — home of the Paris 2024 Summer Olympic Games in the U.S. — enjoyed the largest increase in distribution revenue in this period. That was followed by CBS, FOX, and ABC.

With BIA’s Rick Ducey offering the details, it pointed out that local TV stations typically have three-to-five year agreements with MVPDs and vMVPDs for distribution of their over-the-air signals, known as retransmission consent. While station groups largely negotiate their own distribution agreements with MVPDs, networks have led the way in setting distribution terms with vMVPDs. This distribution is split between stations and their affiliated networks (with “reverse comp” payments), and networks are getting more than half of this revenue.

While ABC’s retrans fees are on the rise and could grow even further thanks to broadcast sports coverage, the pre-Olympic bump for NBC could also result in a new base line for a network that’s poised to regain National Basketball Association coverage for the next decade, beginning in one year.

Interestingly, TelevisaUnivision saw a slight decline in its year-over-year retrans revenue, perhaps due to contractual timing that differs from other networks.

What does the future hold for local TV stations who have come to count on this distribution revenue which, in some cases, exceeds their advertising revenue?

It’s a question many may not like the answer to.

BIA’s latest forecast for local TV station vMVPD/MVPD distribution revenue shows growth from 2023 but an overall flattening in the 2024-2028 period. Of the total amount of distribution revenue in the 2020-2028 period, the Top 25 TV Markets account for over half of the local TV station revenue from multichannel video providers.

The Top 10 markets generate 29.9% of the total and Markets 11-25 get 21.6%.