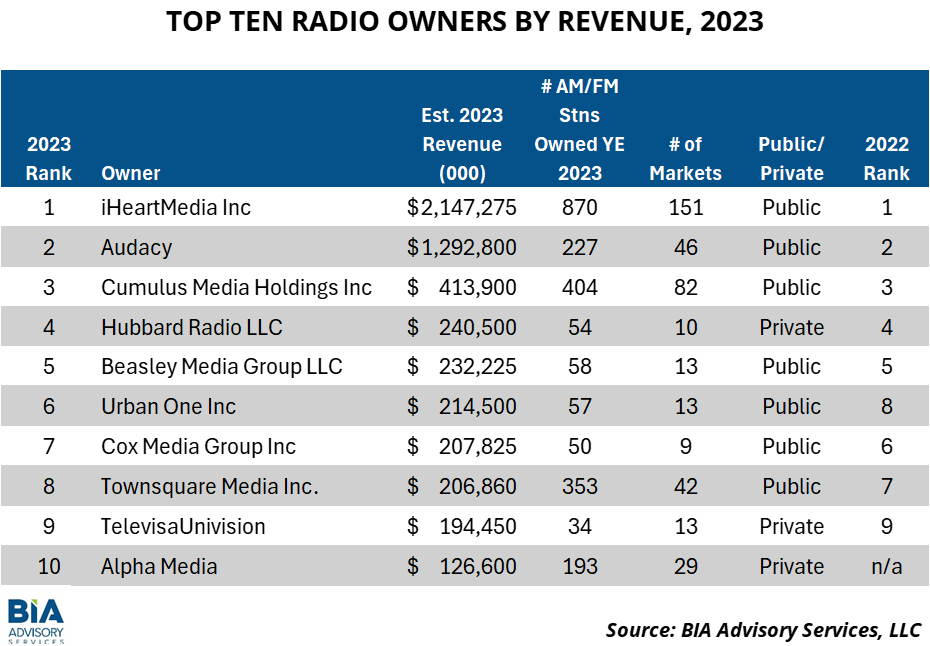

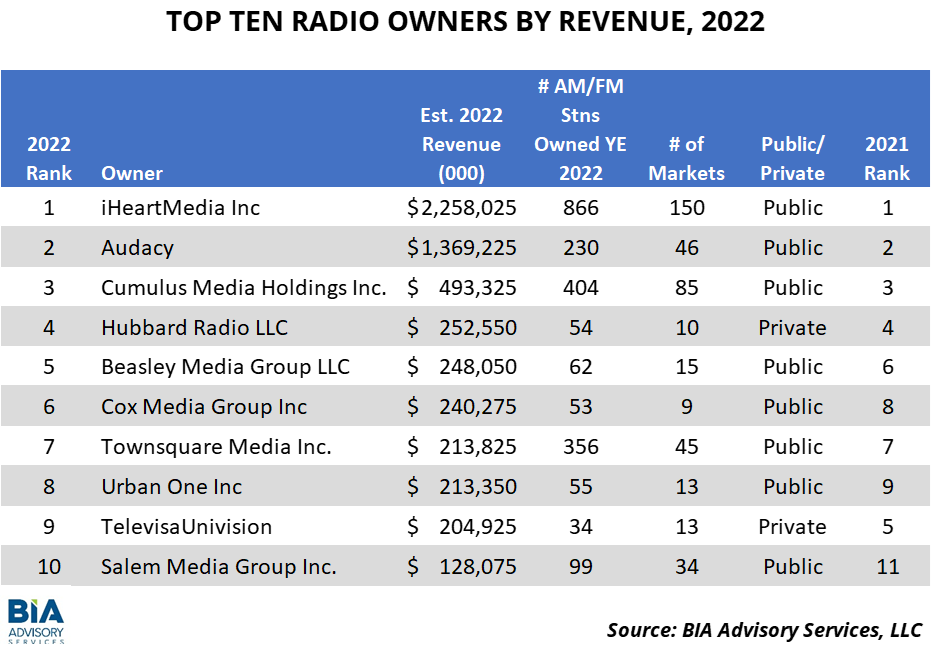

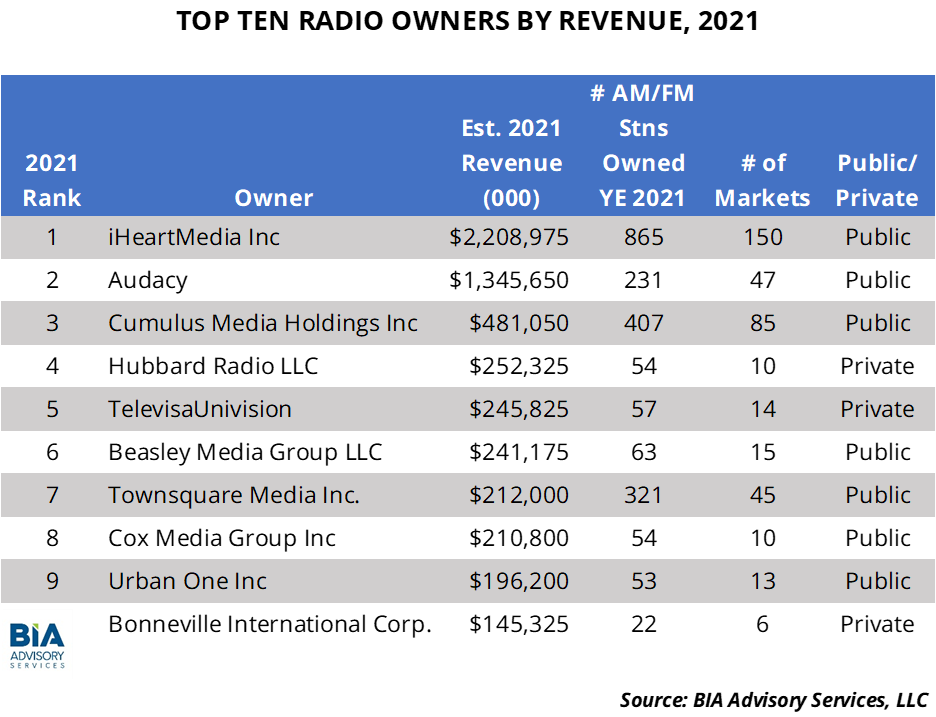

With little fanfare, BIA Advisory Services last week in a blog post shared its Top Ten Radio Owners by Revenue rankings for 2023. The top three slots are the same as they were in 2022, 2021 and 2020.

However, the bigger story is just where the revenue totals landed last year compared to 2022. For the nation’s top companies, the dollars are down.

With the top five radio owners by revenue unchanged between 2022 and 2023, iHeartMedia is again No. 1, fueled by its 870 stations in 151 markets, dwarfing all other companies. The revenue total in 2023: $2,147,275,000. That’s down from $2,258,025,000 in 2022, from four fewer stations (866).

The total revenue for iHeartMedia in 2023 is also down from 2021, when $2,208,975,000 was generated from 865 stations. And, the total is off from $2,562,240,000 from 859 stations in 2019.

In fact, it was only the pandemic-impacted year of 2020 ($1.965 billion) in which iHeartMedia’s revenue was less than that seen in 2023. It also paints a revenue portrait that could explain why the company’s stock price has plummeted in recent weeks.

On May 6, “IHRT” closed at $2.36 per share. Tuesday (5/28) saw “IHRT” close at just 86 cents before bargain hunters came in on Wednesday to help send iHeartMedia shares up to $0.93.

For Audacy Inc., which is preparing to emerge from bankruptcy, $1.292 billion in revenue was seen in 2023 from 227 radio stations, compared to $1.369 billion in 2022 from 230 stations and $1.346 billion from 231 stations in 2021.

The revenue totals for No. 3 Cumulus followed a similar trend, finishing 2023 at $413.9 million from 404 stations (Audacy’s stations are in larger markets, thus accounting for the revenue difference). In 2022, Cumulus’ revenue came in at $493.33 million. In 2021, it was $481.05 million; in 2020 it was $470.13 million but from more radio stations (414 in all).

Also down are Hubbard Radio, and Beasley Media Group, which saw its revenue decline from $248.05 million to $232.23 million between 2022 and 2023.

On a bright note, Urban One is experiencing revenue growth, with dollars rising consistently from 2021 through 2023. However, it saw $226.65 million in revenue during 2019, BIA data show.

Then, there is Cox Media Group, which saw $207.83 million in revenue in 2023 from 50 stations — down from $240.28 million from 53 stations in 2022; $210.8 million from 54 stations in 2021; and $211.15 million from 54 stations in 2020.

Lastly, Alpha Media, which just completed a series of on-air and production-oriented layoffs across radio stations in the Midwest, displaced Salem Media Group on the 2023 rankings.

![Cannes Again For iHeartMedia’s Top Leaders and Talent iHeartMedia CEO Bob Pittman, actor Vilmer Valderrama and President/COO and CFO Rich Bressler attend a Happy Hour at iHeartCafé | La Californie during the Cannes Lions Festival on June 19 in Cannes, France. [Photo: Adam Berry/Getty Images for iHeartMedia]](https://rbr.com/wp-content/uploads/2158288343-scaled-e1718908676612-218x150.jpg)