After numerous warnings, Urban One confirmed late Friday (9/29) that the Nasdaq stock exchange “has initiated a process that could result in the delisting” of the company superserving African American media consumers.

The Listing Qualifications Department of Nasdaq sent Urban One the notice after it failed to file its Quarterly Reports for the periods ending March 31, 2023, and June 30, 2023.

Urban One plans to request a hearing before a Nasdaq Hearings Panel to extend the suspension of delisting action through October 20. Depending on the panel’s decision, the stay could be further extended until March 26. However, there are no guarantees that the extensions will be granted.

That said, Urban One could have made the necessary move to fend off a delisting. Minutes after the initial notice pertaining to the delisting was sent, Streamline Publishing received a second message — including details of the sudden filing of Urban One’s 2023 Q1 Report with the Securities and Exchange Commission. This was expected, per previous statements from the company. However, the filing came as the seconds were ticking down to the end of the third quarter — and the period of time Urban One had to report the results.

The problems surrounding the Urban One delisting, which in no way is tied to its stock price, arose after the company’s Audit Committee dismissed BDO USA LLP as its public accounting firm on July 12. They then appointed Ernst & Young LLP for the fiscal year ending December 31, 2023. During the preparation of its late reports, Urban One identified accounting errors related to non-cash stock-based compensation and its investment in RVA Entertainment Holdings LLC — a.k.a. its stake in the MGM National Harbor casino report in Prince George’s County, Md. These issues are currently under review and have contributed to further delays in the company’s filing of its Q1 and Q2 2023 reports.

On April 3, Nasdaq issued a notice for not being in compliance due to a delay in filing the 2022 Annual Report. Nasdaq had granted the company an extension until September 27.

CABLE TV REVENUE DIP IMPACTS Q1

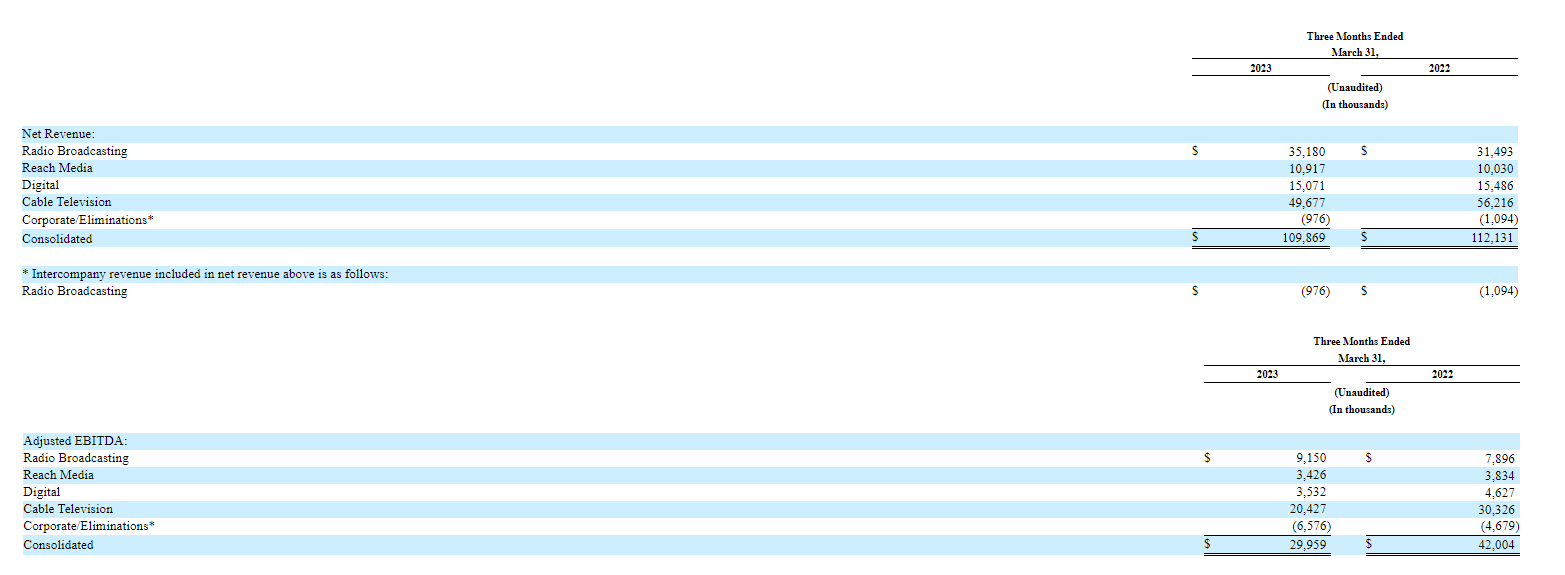

As shared with the SEC, in the period ending March 31, 2023, according to EY’s computations, Urban One’s consolidated revenue fell to $109.87 million, from $112.13 million.

Why? The dip is tied to a decline in revenue from its TV One and Cleo cable television networks, which offset improvements in radio broadcasting and, to a limited extent, its Reach Media national radio arm.

As shown above, consolidated adjusted EBITDA shrank to $29.96 million, from $42 million.

AN UNDERVALUED ISSUE

Unlike the Audacy Inc. delisting, due to the failure to maintain at least a $1 closing price for 30 consecutive days or a $1 finish for at least one day in a quarter, Urban One’s stock is actually considered undervalued by analysts that track the company.

Ahead of Monday’s Opening Bell, UONE, which trades on the Nasdaq, was priced at $5.02, falling 22 cents from Friday. While this marks a year-to-date low, UONE had been a steady mid-$1 stock until May 2020, when social justice events involving African American issues propelled UONE for a brief period, before settling in its current $5-$7 range.

Comparatively, “UONEK,” a preferred Urban One stock, has seen more resilience against macroeconomic concerns and has maintained its value — also while being seen by analysts as undervalued.

— Reporting by Cameron Coats, in New York, and Adam R Jacobson, in Dallas