A seven state Electoral College race in the U.S. presidential race is great news for TEGNA, with record political ad spend poised to impact six of those states — each home to broadcast TV stations owned by the company formerly known as Gannett.

At the same time, big Olympic Games Paris 2024 ratings across TEGNA’s NBC stations, as it is the biggest affiliate group for the network, is driving Q3 revenue growth for the company.

Those were the two key takeaways delivered by outgoing CEO Dave Lougee in his final earnings call for analysts and investors, ahead of a leadership change poised to come next week.

Mike Steib (pronounced “STIBE”) took a moment on the Q2 call to thank Lougee, calling his legacy “a real legacy for me. His ongoing counsel will prove to be valuable.”

That’s a strong statement from Lougee’s successor as CEO, a transition that at the start of 2023 wasn’t expected. At that time, an acquisition by Standard General and merger with Standard Media was still being engineered by Soohyung Kim, a dissident TEGNA shareholder who had unsuccessfully sought a Board of Directors seat in a bid to gain greater influence over the company. Soo believed TEGNA’s performance was short of expectations. Had the Standard General deal, which saw Apollo Global Management come in as a non-voting minority interest holder, gone through, Deb McDermott would have succeeded Lougee.

The FCC’s Media Bureau put a stop to the deal over concerns regarding its structure; Soo saw it differently, and charged the Commission with racial discrimination with Holly Saurer, the Media Bureau’s head, sending the Standard General acquisition proposal to an Administrative Law Judge for a hearing.

That’s now far behind TEGNA, which has had a bumpy ride on Wall Street. Shares are off by 2.7% since today in 2019 and are off by 5.2% year to date.

Still, the industry has largely viewed Lougee as a strong leader who has guided TEGNA through the rapids across his years at the top.

“As I approach my final days as CEO, I want to thank all our TEGNA stakeholders for making the last seven years leading this great organization the highlight of my career,” he said. “I am extremely enthused about the addition of Mike Steib as my successor, with his strong track record of performance and results … I look forward to following Mike’s journey closely and to being a trusted advisor to him through this transition.”

BEHIND THE NUMBERS

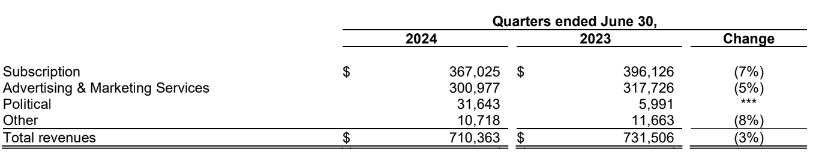

With TEGNA CFO Julie Heskett offering details that included her noting the ad categories of Automotive, Home Improvement, Retail, Healthcare and Media/Telcom were “a drag” on the company in Q2, total company revenue decreased by 3% to $710 million. Year-ago revenue came in at $731.51 million.

That barely beat the low estimate of $709.9 million offered by one of 6 analysts polled by Yahoo! Finance. The other 5 predicted revenue to be higher, resulting in a consensus estimate of $715.28 million.

Excluding a $136 million merger termination fee paid by Standard General in Q2 2023 to TEGNA, operating income fell to $141.86 million from $145.6 million.

Put it all together, and net income attributable to TEGNA declined by 59% due to that one-time, year-ago cash infusion, moving to $82.14 million ($0.48 per share) from $200.11 million ($0.92). Five analysts predicted earnings per share of between $0.46 and $0.50.

On a six-month basis, net revenue was down 11% to $271.7 million ($1.55 per diluted share) to $304.41 million ($1.37).

Heskett also shared that 2024 guidance remains unchanged, Heskett said. And, Q3 growth is forecast to be up 9%-12%, thanks to strong political and Olympics revenue.

“National is the macro concern and the tougher comp for us,” Heskett added in response to analyst Craig Huber during the Q&A session, noting that Automotive in Q2 was down double-digits, a “big turn in that category specifically, and you’re seeing that in Tier 1 and Tier 2, which is the national side of the business. On a positive note, Automotive has returned on the linear core side here in Q3.”