NEW YORK — On March 4, Entravision Communications received word from Facebook, Whatsapp and Instagram parent Meta that it intends to wind down its authorized sales partner (ASP) program globally and end its relationship with all of its ASPs by July 1.

With a significant revenue loss pending, how did the company fare in Q1?

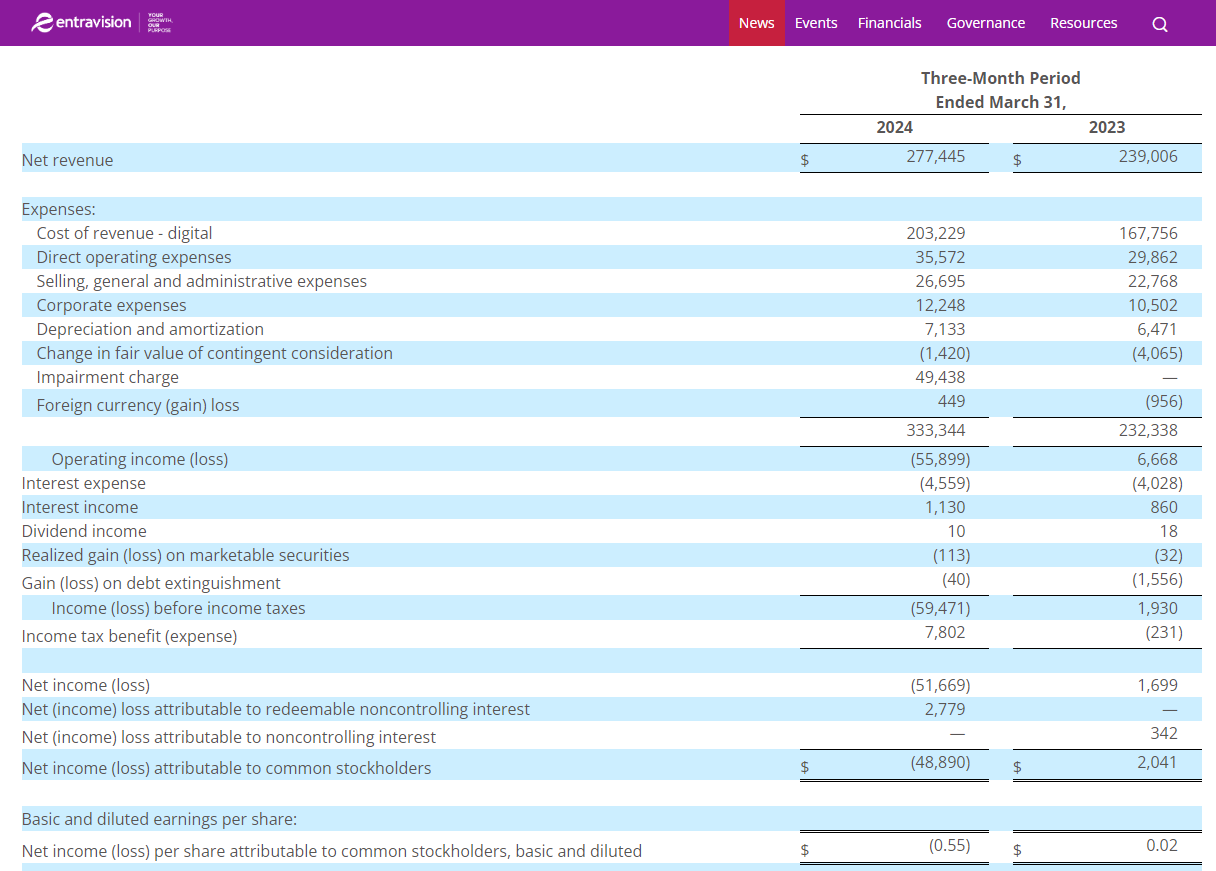

Net revenue grew by 16% to $277.45 million, from $239 million, beating the Street, as an analyst polled by Yahoo! Finance, Entravision was expected to report a loss per share of -$0.09, compared to earnings of $0.02 in Q1 2023.

But the bigger news is that consolidated EBITDA shrank to $4.53 million from $13.02 million in the first quarter of 2024.

Entravision CEO Michael Christenson commented, “While we are disappointed in Meta’s decision, we have a solid balance sheet and a strong cash position, and we are confident in Entravision’s long-term opportunities.”

He added that the company has initiated “a thorough review” of its current digital strategy, operations and cost structure.”

EXPENSES EAT AT EARNINGS

For Entravision, a Q1 increase in cost of revenue for digital widened to $203.23 million from $167.76 million, as direct operating expenses also climbed. In fact, expenses were up across the board. Add in a hefty $49.44 million impairment charge, and total expenses rose by $101 million.

This led to a net loss attributable to common stockholders of $48.89 million (-$0.55), compared to net income of $2.04 million ($0.05) in Q1 2023.

“We remain focused on our 2024 priorities: maximize our political revenue in a year in which our audience will be critical to determining the outcome of the 2024 U.S. elections, provide highly-rated news and content to our audience, and build Smadex, our programmatic ad purchasing platform,” Christenson said.

DIGITAL REMAINS THE BIG REVENUE SOURCE

Once again, television and “Audio,” which includes Entravision’s broadcast radio division, saw revenue that paled in comparison to its global digital offerings.

As shown below, digital revenue grew 21%, to $237.49 million, while television revenue slumped by 6% to $28.55 million.

Audio revenue was down 7%, to just $11.41 million.