As the first quarter of 2021 neared its conclusion, the audio media company that for more than 50 years was known as Entercom changed its name, and that of the Radio.com platform it acquired via its CBS Radio merger and largely rebuilt.

Now Audacy, the Philadelphia-based company led by David Field is seeking to build on its momentum as a podcast and streaming audio leader. Still, its chief revenue driver is Radio. And, in its final quarter as Entercom, that reality is a punishing one. The company’s revenue missed Wall Street estimates, while its earnings per share fell short of expectations by 2 cents.

Commenting ahead of Audacy’s earnings call with financial analysts, Field struck a reflective tone. “We are in the midst of a strong, albeit uneven, advertising recovery reflecting the nature of our business mix,” he said. “First quarter digital revenues grew 17% and national revenues rebounded to prior year levels, but local ad revenues remained behind as many of our customers continue to be impacted by the pandemic.”

Field added that, because the local radio advertiser base is weighted toward later-stage recovery categories such as restaurants, concerts and entertainment, movies, travel, and theme parks, recovery is coming. It just didn’t happen in the first three months of 2021.

“We anticipate a strong recovery of local advertising across these businesses during the third and fourth quarters,” Field said.

He pointed to second quarter pacings and easy year-over-year comps, with 60% improvement from the depths of the COVID-19 pandemic. Still, sixty percent from some of the most difficult times in modern memory may not be enough for those seeking a comeback akin to that of broadcast TV. Field has a response to those industry observers.

“Our average local customer spending levels are now exceeding their average 2019 spending levels,” he said ahead of a 10am earnings call. ”

But, Field added, “Total local ad spending is down because of a decline in the number of customers with a significant majority of those inactive accounts concentrated in later-stage recovery business categories.”

BEHIND THE NUMBERS

Just how did Entercom perform in its last days, as it would be perhaps unfair to Audacy to claim the first three months of 2021 as its own?

Net revenue declined to $240.76 million from $297.03 million even as corporate expenses were trimmed to $211.42 million from $249.55 million.

Due to the lower radio advertising dollars, an operating loss of $8.23 million was seen, compared to operating income in Q1 2020 of $11.36 million.

As such, the net loss widened to $21.65 million (-$0.16 cents), from $9.14 million (-$0.07).

Analysts expected a net loss per share of $0.14 and revenue of $244.85 million.

As trading began on Friday, AUD (formerly ETM) was off 19 cents to $4.61.

Like the financial results seen by companies including iHeartMedia and Entravision, digital — for Audacy, including podcasting and its Cadence13 and Pineapple Street entities — was the dollar darling in Q1.

Spot revenue and its net revenue were off significantly.

Political was down to $1.26 million from $7.74 million, but core ad revenue didn’t fill the gaps as strongly as it could.

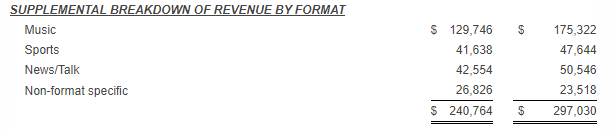

Unlike other media companies, Audacy broke out revenue “by format” — but not by Top 40 versus Alternative or Country, per se. It measured the revenue of its music stations against its spoken word properties.

And … all were down year-over-year.

Put it all together, and Adjusted EBITDA declined to $10.29 million from $34.52 million. Adjusted Free Cash Flow moved to a negative $17.45 million, from positive FCF of $802,000 in Q1 2020.