Cumulus Media stock, which trades on the Nasdaq market, was up by more than 7% in before-the-opening bell activity on Friday — a positive Wall Street reaction to the audio content creation and distribution company’s just-released second quarter results.

While Atlanta-headquartered Cumulus experienced a year-over-year quarterly loss on extremely difficult comps, as 2022 included record political advertising revenue, Q2 2023’s earnings per share beat the consensus estimate offered by 3 analysts polled by Yahoo! Finance, coming in at the high estimate of -$0.03.

DIGITAL SAVVY SAVES THE QUARTER

Overall, Cumulus Media performed in-line with expectations while adjusted EBITDA exceeded them, President/CEO Mary Berner shared as she detailed the company’s three-month period ending June 30 in an early-morning call for investors, debtholders and financial analysts.

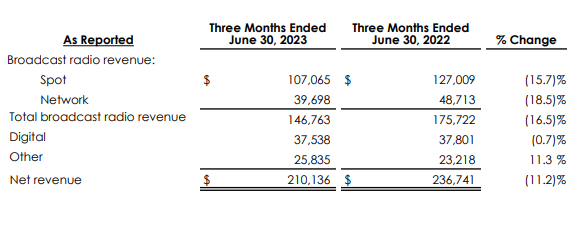

However, “softness” in the overall advertising market remains Cumulus’ biggest specter. This overshadowed digital prowess, which all but saved Cumulus in Q2, helping it not only surpass the EPS consensus estimate of -$0.37 but also the revenue projection from analysts of $208.78 million. In Q2, revenue came in at $210.14 million, down 11.2% from $236.74 million one year ago — in-line with expectations.

Put it all together, and Cumulus swung to a net loss of $1.068 million (-$0.06 per diluted share), compared to net income of $8.65 million ($0.42) in Q2 2022.

Adjusted EBITDA declined to $30.68 million, from $41 million.

Within 10 minutes of the release of the results, CMLS surged to $5.20 per share, up 7.4% from Thursday’s closing value. By 10am, a 14% gain to $5.52 was seen. That’s a positive jump for Cumulus stock, considered “undervalued” by the trio of analysts who cover the company.

Cumulus shares have not been priced at this level since the end of February.

As CFO Frank López-Balboa detailed on the earnings call, the weakness in the advertising market remains a big challenge. But, digital revenue — which Berner says now comprises 18% of the total number — shined, offsetting some of the overall headwinds.

Cost reductions “across multiple paths,” Berner said in response to Michael Kupinski at Noble Capital Markets, who asked about how it was being carried out. Real estate costs, general contracts and “looking for areas of efficiency” are leading to the cost reductions. And, while Cumulus has a “slimmer work force” than three or four years ago, López-Balboa said, Berner noted that being “live and local” across its markets is something the company is committing to.

Then, there are non-essential asset sales, which are a key part of the Cumulus Q2 ’23 story. López-Balboa remains “optimistic” about non-essential asset sales — with KABC-AM in Los Angeles among the properties available to the right buyer. Cumulus has agreed to sell WDRQ-FM in Detroit to Family Life Radio for $10 million; the deal was announced toward the end of Q2.

What are some of the positives López-Balboa and Berner shared within the first 15 minutes of the Cumulus earnings call? Net debt has been reduced by 42% since 2019. Some 10% of outstanding Cumulus shares were retired through a tender offer — a big differentiation point between Cumulus and industry peer Audacy Inc., which multiplied its shares 30-fold through a reverse stock split designed to one day regain compliance with NYSE.

And, with “significant growth” in Cumulus’ digital marketing services, liquidity was also placed in the spotlight by Berner. This income growth is helping Cumulus in “maximizing performance during difficult times,” and mitigating downsize where Cumulus cannot control outside influences in its revenue-generation structure.

RETAIL WOES FOR RADIO

While investors, and the radio industry, have much to cheer about with respect to Cumulus’ results, current softness in the national market was something Berner addressed. It’s a big concern, as macro-driven challenges in National are, in Berner’s view, the result of reduced or eliminated spending from national advertisers in a competitive market.

For López-Balboa, it is a timing issue, rather than a permanent reallocation of dollars.

By category, Retail and Financial Services were hit particularly hard in the quarter. In contrast, Consumer Packaged Goods (CPGs) saw improvement year-over-year.

For Cumulus, Local comprises 50% of the company’s total revenue, while 45% of total revenue is attributed to National. This hurts Cumulus-owned Westwood One the most. López-Balboa also noted that, in Q2, podcasting was impacted by decreased direct ad spend.

CUMULUS BY THE NUMBERS

- Local revenue excluding digital was down 7% in Q2

- Including digital, local was down 5%

- Automotive revenue is on the rise, with with April up 2%, May up 10% and June up 14%

- Poor year-over-year comps mean Cumulus in Q3 is pacing down in the low double-digit range

Additionally, Cumulus’ long-term debt tied to its 6.75% senior notes lowered to $346,245,000, from $380,927,000. The company’s outstanding term loan payments due 2026 are down to $334.7 million, from $338.45 million.

Still, some industry observers may be looking three years into the future already, asking how Cumulus can overcome the 2026 due date without exchanging old debt for new debt.

Cumulus Media CFO Frank López-Balboa noted that Cumulus Media is not offering guidance at this time.