May marks a time of year when advertisers, media agencies and networks crouch to their starting-block positions in anticipation of the start of TV’s upfront marketplace. Like so many years past, thoughts run the gamut from what will be the hottest new programs to which networks or agencies will set the pace for the pricing of national TV commercial inventory during the coming year. The upfront process can be thought of as the ultimate sausage-making machine with as much as 65%-80% of the ingredients (one year’s TV inventory) being squeezed through for sale over the course of a six-week period. As this annual event unfolds, it makes sense to reflect on its true purpose: to deliver entertainment to viewers while tendering marketing value for the event’s ultimate underwriter, the advertiser.

For an advertiser, committing millions of dollars to a TV campaign budget is really the final step within a much longer process that involves establishing a budget, understanding the consumer target, producing the commercials, vetting the multitudes of TV network and program offerings, evaluating synergy with non-TV media, planning and scheduling the pacing and spacing of the TV spots, then, finally, executing the plan. So, it seems fitting to think about how well the final TV buy reflects the intentions of all the preparatory steps that came before. In order to get insight into the process, let’s first take a look at the dynamics of TV audience fragmentation and its potential for enabling the targeting of a diverse U.S. population. We will then follow this with a view on the quality and impact of steps taken in today’s advertising/media planning process that lead up to the actual placement of millions of commercial spots for advertisers.

The Big Bang of TV Fragmentation

Media audience fragmentation has been a fact of life for nearly three decades. Even before the internet spawned millions of sites, social networks, search engines and blogs, a big bang of media choice was in the making. This explosion in media options manifested itself in the proliferation of TV outlets, magazine titles, radio stations and newspapers, catering to the quilt work of changing consumer tastes within a quickly diversifying U.S. population.

Focusing on TV, the seminal move towards audience fragmentation occurred in the late 1970s when cable and satellite operators presented an alternative to over-the-air TV. The wide-bandwidth transmission technology of these then-emerging platforms made it possible to provide viewers with a multitude of channels, more than they could ever receive through rabbit-ears or rooftop antennae. Premium movie networks like HBO appeared on the scene as well as a dozen or so ad-supported networks like ESPN, USA, TBS, A&E and Lifetime. Today, this forty-year-old foothold of fragmentation has morphed into smithereens of options as there are literally hundreds of networks available for those who want to watch only sports, only news, only pop entertainment, only investment advice, etc. in one sitting.

TV Fragmentation: Friend or Foe? TV audience fragmentation can be viewed as both an opportunity and a challenge when evaluating on which networks and shows to place advertising. On the plus side, advertisers have the potential to tailor communications to specific consumer segments that reflect the ever-expanding variety of lifestyles, product consumption patterns and cultural denominations that make up the population. For example, they can run commercials for golf clubs on the Golf Network, for marinades on the Food Network and vacation packages on the Travel Network. But what happens when they want to find viewers of this TV fare, or others like them, on other channels/programs? The reality is that they don’t watch just the Golf, Food or Travel networks. Or how about advertising a product like laundry detergent or toothpaste, where everyone could presumably be the target audience? In this case, how can audience fragments be amassed during the media placement process in such a way to make up the most meaningful prospective group of viewers for brands? And how can advertisers be assured that there is enough commercial weight against their target to have impact?

To gain full insight into the question of how well current industry TV placement practices address TV audience fragmentation we need to examine the process of translating TV media plan goals into the actual purchase of specific networks and programs to support the campaign. In other words, how well do the TV programs on the ad schedule deliver the target audience in terms of descriptive match and communication weight?

Understanding who the target consumer is and what he/she watches on TV is a first critical step in this process. Today, many advertisers and their agencies conduct surveys and/or trawl customer data bases to produce rich psychographic and demographic descriptions of their consumer targets. Maintaining the integrity of these consumer target profiles from the first step in the planning stage all the way to the purchase of TV commercials, however, has been a long-standing industry challenge for a number of reasons. The obstacles lie in three key areas: TV audience data limitations, setting realistic effectiveness goals and program bundling in the TV buy.

1. TV Audience Data Limitations -Today’s TV audience data is weighed down by two critical shortcomings:

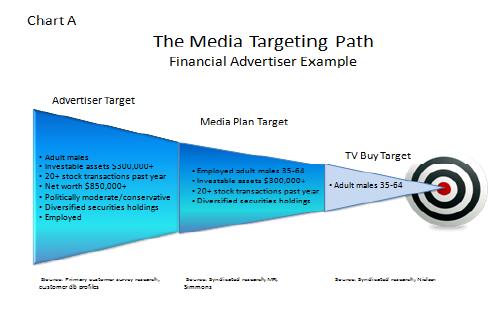

a. Weak link between consumer targets and viewing data – The often elaborate target audience descriptors and insights developed by advertisers are subject to a laundering process by the time they reach the TV buyer’s desk (See Chart A). Media planners attempt to replicate the advertiser target with MRI or Simmons to develop planning targets which are not directly linkable to the TV viewing data deployed to transact the TV buy. Instead, buying targets, simplified offshoots of the planning targets, serve as a proxy for target audience delivery. These age/sex demographic targets are still dominant means of transacting TV buys despite all the advances made in consumer research and data base mining.

b. Lack of reporting granularity – Sample sizes of today’s TV measurement panels often cannot support the capture and reporting of the bulk of fragmented TV viewing. So reporting for even basic demographic targets is limited to higher-rated programs and networks while audiences of other outlets either are obscured within the confines of weekly or monthly ratings averages or altogether absent. This granularity gap is critical, for example, to advertisers with day-of-week strategies like a retailer with a one-day Friday sale looking to run promotional ads during the Wednesday and Thursday before the event. There are likely to be networks, programs and time periods where no reportable ratings are available during these specific days, particularly within daytime and late night when viewing activity is lower which means missed advertising opportunities. This is especially true for smaller targets like teens or women 18-24.

2. Setting Effectiveness Goals

Media planners own the important role of setting campaign ad effectiveness goals to ensure there is sufficient advertising weight to make a positive ripple in brand awareness, purchase intent, sales, maintenance of market share, etc. Very simply, effective frequency planning works on the principle that too much advertising is overkill and too little ineffective, an extreme on either end of this spectrum is wasteful. But a close examination of ad exposure frequency for typical TV campaigns demonstrates a very strong tendency to do just that – over saturate some viewers while only lightly touching others. Chart B demonstrates this lopsided audience delivery of Adult 18-49 viewers for a T-Mobile campaign: nearly 80% of ad impressions reached only 40% of the target. And it is also current practice to focus only on the ad frequency of those reached by the campaign, ignoring (albeit not deliberately) a healthy portion of consumer targets that are missed by TV schedules.

If we drill further down into this target audience saturation scenario, we find another layer of imbalance in TV delivery: lighter, more upscale viewers are in short supply. Chart C shows that viewers with household income less than $50K have the opportunity to see twice as many T-Mobile commercials compared to people in the $100K+ category. For example, the heaviest lower-income viewers were privy to 22 commercials compared to 13 for the heaviest upscale group. The same relationship is true for lighter viewers in both income segments, where the lower-income segment was exposed to three ads compared to 1 for the $100K+ group.

So far we’ve seen how a target audience transforms into a broader definition and the challenge of meeting effective communications goals when scheduling the TV buy. Now, let’s look at the final step in the process: executing the TV buy.

3. CPM and Inventory Bundling

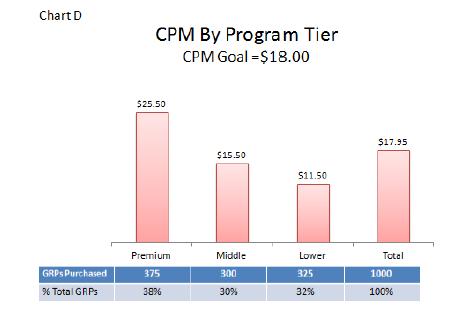

When TV buyers go to market they are armed with a buying target and a CPM goal to secure a specified number of gross ratings points (GRPs) to drive a client’s business. If the media agency has done its homework, there is also a list of preferred TV programs/genres identified during the planning process that the buyer is instructed to focus on if the program inventory price is right. On the network/station side, account execs are directed to sell all inventory, including commercials in programs for which there is lower demand; in general, they almost always bundle premium-priced inventory with lower-tier, less expensive supply. The hypothetical example in Chart D demonstrates the swing in CPM by program tiers to buy 1,000 GRPs. To meet the CPM goal of $18.00 and also secure premium shows for the campaign, the buyer must include middle- and lower-tiered programming. Both parties walk away with some value from the transaction: sellers unload less desirable inventory and buyers secure programs that meet buying target GRP requirements while achieving the $18.00 CPM goal.

The bundling trade-off focuses primarily on marketplace supply and demand using buying-target CPMs as the currency of exchange. So at the end of the TV advertising placement process, the reality of a CPM-driven world and the forces of the TV marketplace hold the potential for an advertiser to go further astray from reaching the target audience. At this point the TV buyer is concerned about meeting the CPM target, quite possibly at the expense of delivering the viewers who are in the planning target.

Realizing the Opportunity of TV Audience Fragmentation

A few decades ago, the splintering of TV audiences was seen as a disruptive annoyance to the industry due to the increased labor intensity of scheduling ads across an expanding spectrum of options. It can be said that this surge in complexity fanned the flames of growth for independent media agencies who now proudly take on the intricacies of media choices as a badge of honor. But today the industry is not taking full advantage of TV fragmentation. There is still limited ability to identify the most fertile slivers of audiences that collectively comprise the essence of an advertiser’s target. A review of the targeting process clearly demonstrated the potential to water down the true target description, starting from the media planner’s syndicated rendition and ending in the throes of age/gender CPM bundling in the TV buying marketplace. The inability of TV schedules to meet ad frequency communication goals for large portions of viewers further complicates matters.

In order to realize the opportunity to use TV audience fragmentation as a means of elevating current TV targeting and scheduling processes, the advertising/media industry must come together and pursue key changes:

* More granular TV data = larger sample sizes

o As TV fragmentation expands, audience ratings get tinier so increasing current measurement systems’ sample sizes is in order

o Supplementing current measurement systems with set top box data holds strong potential and is an inevitable step in improving the reliability of today’s viewing estimates

* Richer audience descriptors

o Audience detail should map more closely to an advertiser’s original description of the target

o Appending current measurement systems with third-party descriptors is the answer

* These descriptors can be specific to industry: e.g., automotive, CPG, insurance, financial.

o Progress is being made in this area by companies such as Simulmedia, TRA and Rentrak, however, widespread industry adoption is moving slowly.

* Marketplace TV transactions

o Target delivery should better reflect the original target vs. the buying target

* Transactions can still be negotiated on buying target, however, buyer and seller should have access to “original” target ratings to inform superior selection of programs

o Change in the air for the upfront structure?

* The upfront practice of purchasing inventory bulk months/quarters in advance likely needs to be reassessed; the reality is that TV audiences are in constant flux and that a purchase made this year for a program airing in March 2013, may miss the targeting mark.

* Working with Big Data

o The advertising/media industry’s data handling is behind other industries in terms of both systems used and human resource skill sets.

* Investments in technology infrastructure and accelerated recruitment of personnel with strong quantitative training and background are critical to push the industry forward. This movement has already begun in the online/digital world and must find its way into the realm of TV for more effective planning and scheduling.

The list above is a tall order, considering the marshalling of resources and time required to set the process in motion. But the fact remains that money is being left on the negotiating table when current practices fail to achieve the end goal: more effective targeting and placement of TV advertising. And as TV audiences continue to fragment the price gets higher for advertisers, who, in the end, are paying much of the freight for the system. So, as we reflect during the upfront buying season, let’s make ourselves a promise for next year and all the ones that follow: that we will take a unified step towards improving a system that will pay back rewards to its ultimate underwriter, the advertiser.

–Gerard Broussard is a media research/analytic industry veteran whose background includes CBS Television Network, Ogilvy, MediaEdge, GroupM and, most recently Canoe Ventures.