In April 2014, a retransmission consent agreement between one of the largest privately held broadcast television groups and a direct broadcast satellite provider was reached. It ended a 14-hour impasse that led to a brief “blackout” of its stations to Dish customers.

Three years later, in April 2017, a fresh stalemate between Dish and the TV station owner was resolved with a new retransmission agreement, ending two months of blocked access to the company’s broadcast properties, by law.

Now, history has repeated itself, as another two-month impasse between the DBS provider and Hearst Television has quietly come to its conclusion.

“A resolution was reached Friday night,” a Hearst spokesperson confirmed, directing RBR+TVBR to Dish for a formal statement.

The lone PR Newswire release from Dish, however, seen since the release of its Q3 2023 financial results last week was a Monday announcement confirming the appointment of Hamid Akhavan as President/CEO; the news was widely reported with the resignation of W. Erik Carlson, which sent DISH shares further descending in value. Today trading at $3.32, DISH was priced at $15.64 to start 2023.

Dish elected to confirm the end of the third retransmission consent dispute in a decade with Hearst with a brief statement sent to the media. “We’re pleased to have reached a long-term agreement that benefits all parties and most importantly, our customers,” said DISH EVP/Group President of Video Services Gary Schanman. “Thank you to our customers for your patience and understanding as we worked through the negotiations.”

As RBR+TVBR reported on November 6, the absence of Hearst’s television stations played at least some role in a disappointing Q3 for Dish. For the three-month period ending September 30, Dish suffered a net pay-TV subscriber decline of some 64,000 customers, compared to a net increase of some 30,000 in Q3 2022.

This illustrates how customers, even when told a MVPD negotiated “in good faith” with a broadcast TV station owner, are expressing their frustrations by switching services. In Dish’s view, the retransmission consent disagreement resulted from Hearst “demanding tens of millions of dollars in rate increases that would affect customers, while it devalues its product by making programming available elsewhere, even as viewership declines.”

And, it was Schanman in September who assailed Hearst for forcing Dish customers to “foot the bill” when it came to giving the broadcast TV station owner what it believes is fair compensation for the right of Dish to profit from its product.

For its part, Hearst said, “We have made significant investments to deliver top tier programming to our viewers, and DISH is seeking the right to carry our stations at below market rates, which is neither fair nor reasonable.”

While terms of the new agreement were not disclosed, it shows that, even with the rhetoric shared in September, the two sides were able to reach an agreement favorable to both parties.

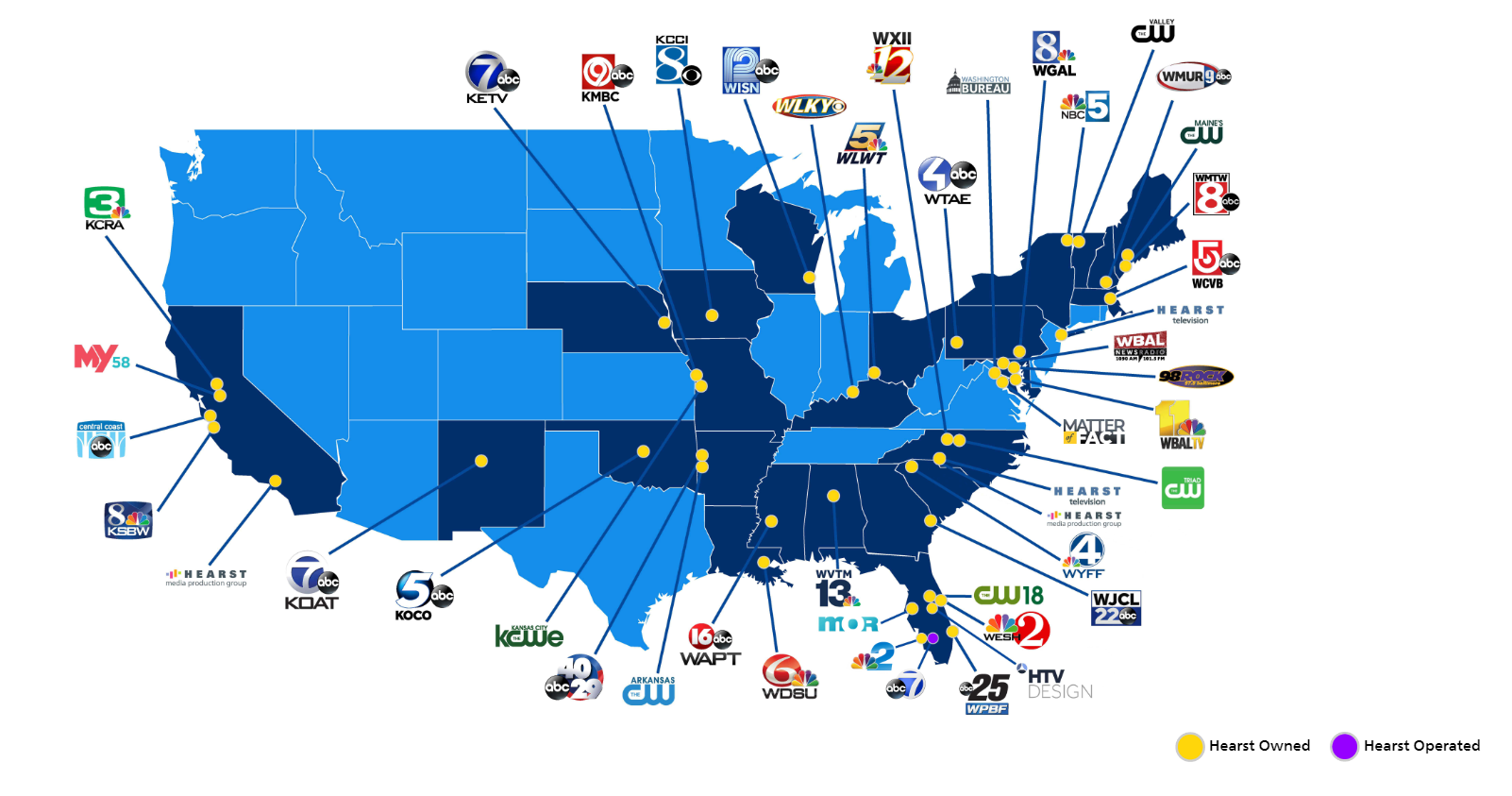

The impacted Hearst stations are shown in the map below: