Resetting expectations, refocusing inward and recharging growth.

That’s the key takeaway from pwc’s just-released report offering perspectives from its Global Entertainment and Media outlook for 2023–2027.

What does pwc have to say about broadcast media, in particular?

RBR+TVBR reviewed the report, which puts Music, Radio and Podcasts into one category and Traditional TV in another, while OTT has its own classification.

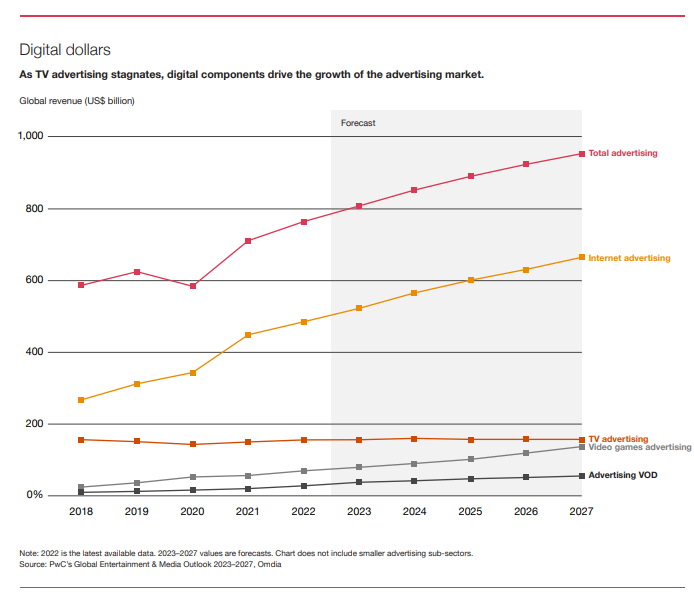

TV advertising got scrutinized. And, to little surprise, it is stagnating … only, not just domestically.

But, pwc predicts that over the next five years revenue from ad-supported video on demand is set to nearly double. “Indeed, the streaming industry has switched from one that promised to liberate its paying subscribers from watching advertising to one that relies on advertising as a core revenue stream,” it says.

RADIO REVENUE MALAISE

For Radio in the U.S., advertising grew slightly last year — although it remains down from its pre-pandemic total and is not predicted to reach that during the forecast period, pwc concludes.

Total ad spend on radio in the U.S. and Canada rose to $16.04 billion in 2022 from $15.55 billion in 2021. This still trails 2019’s $18.42 billion. Pwc did not break out the U.S. from its neighbour to the north.

Will North American radio revenue recover? Pwc says ad spend this year is estimated to reach $16.2 billion, about a 1.2% rise. But, it notes the forecast calls for radio advertising to increase at a compound average growth rate of just 0.94% throughout the forecast 2022-2027 period.

Translation: By 2027 the $16.6 billion in revenue will still be “well behind” its 2019 total of $18.42 billion.

Terrestrial broadcasting advertising is forecast to remain the biggest share of radio spend through 2027, but this will inch downward from $12.75 billion in 2023 to $12.71 billion in 2027.

Terrestrial online has faster five-year CAGR of 4.96%. But, the spend in 2027 is expected to come in at just $3.9 billion. While that’s up from $3.26 billion this year, the growth simply isn’t fast enough to combat the core ad trend decline.

What about Sirius XM? Satellite radio’s compound annual growth rate for the period of 2022-2027 is estimated to be 1.63%, reaching $210 million, up from $200 million this year.

Overall, the biggest conclusion pwc offers is that there is a “creative imperative” that must be executed over the next five years.

“As we look ahead, it’s important to keep an eye on the big picture,” it says. “In the coming years, there will be more inflection points beyond the continued rise of advertising and the growth of digital. A tipping point will be reached in 2025, when global 5G penetration will surpass that of 4G.”

But, pwc says, in a period of muted top-line growth, companies have to continue to reassess and refocus if they’re to avoid further retrenchment. “While participants in these markets have always had to be nimble and resilient to changes, the stakes are rising,” it says. “As we look ahead, evolving consumer behavior, a shifting regulatory environment and disruptions posed by new technologies will create new tensions and open up new possibilities.”

Pwc asks if data protection efforts “put a brake on the efforts to use AI to personalize advertising,” and if new virtual reality (VR) developments set the stage for rapid growth in that sector. It also asks if “highly wired smart stadiums provide a new platform for combining the potential of in-person events and digital services.”

Whatever pathways open up, pwc concludes, the imperative will be to lean into innovative thinking. “The entertainment and media industry has always been, at root, a creative endeavor. But now, that creativity must be extended into multiple dimensions, and must be harnessed to a purpose. In the coming years, armed with powerful technology, leaders will have to be more creative about how they create, distribute and monetize products and services. They’ll have to think hard about how to generate and measure returns on the substantial investments they are making. And they’ll have to be creative about how they pursue and generate growth.”