J.D. Power has released its finding of a “pulse survey” of 1,232 U.S. adults that delves into their viewing preferences, usability challenges and future plans for using subscription-based video on demand (SVOD) services.

What does it show? Streaming has become important to consumers “stuck at home” due to the COVID-19 pandemic. And, even as a sense of “new normal” begins to take shape across the U.S., it will likely stay that way.

What does this mean for broadcast TV stations and MVPDs?

Among the specific findings from the survey:

- Some 67% of streaming customers say they are spending “somewhat” or “substantially” more time streaming than they did before COVID-19. The average viewer spent 18 hours streaming in the past 7 days.

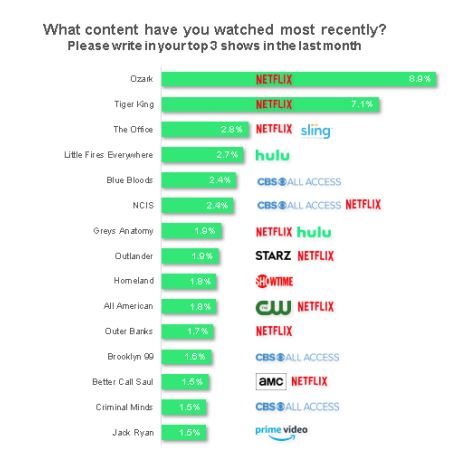

- Netflix delivers most trouble-free streaming, with users reporting just 0.07 problems per hour, roughly half the problem incidents of Amazon Prime Video, Disney+ or YouTube TV. The top three most popular titles streamed are all on Netflix: Ozark, Tiger King and The Office.

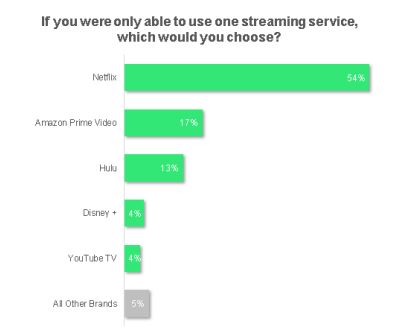

- Streaming has become essential expense despite financial hardship caused by COVID-19: 84% plan to keep their subscriptions and 11% plan to add new services; majority of streaming customers (54%) say they would choose Netflix if they were only able to use one streaming service.

Redefining ‘Must-See TV’

Remember when everyone made an appointment to watch NBC on Thursday nights? J.D. Power believes that same fervor is now being directed to the on-demand streaming services. Even though roughly 40% of those surveyed say they expect their financial situation to be worse in two months, streaming has become an essential expense.

“Here again Netflix emerges as a standout,” the report’s author, Ian Greenblatt, managing director of TMT Intelligence at J.D. Power, notes.

Thus, broadcast TV and MVPDs need to understand just where eyeballs are going when they are not consuming their own offerings.

But, perhaps the most telling graphic reflects what shows respondents watched in the last month, reflecting late March to late April, when stay-at-home edicts were largely put into place.

As one can see, the lack of fresh prime-time programming, combined with the absence of live sports, likely fueled a rise in OTT consumption. Further, Better Call Saul — one of the few remaining draws on AMC — is also available on Netflix, diminishing the need to have a cable TV package in order to receive the show.

With such trends, Upfronts focused on prime-time scripted programming may become a thing of the past, as networks take the lead of their affiliates by doubling down on unique content they can own — local news, daytime fare, and live event programming.