It’s nice to be loved. It’s even sweeter when that adoration comes from a Wall Street player, and you are a publicly traded radio broadcasting company.

The object of Kippington Capital Management‘s affection? Entercom Communications.

Entercom on Thursday (4/26) received top billing in a two-part segment on what Kippington calls “two very well-run ‘old media’ companies.”

Without revealing the second company Kippington will profile, the hedge fund notes, “The companies bear certain similarities: strong brands and competitive positions, significant insider ownership, defensive moats, and strong cash flow. Despite this, the market has discarded them due to a variety of factors, and their valuations reflect this. Both present excellent opportunities for disciplined long-term investors.”

Offering potential investors a brief history of Entercom, founded in 1968 by Joseph Field with the belief that FM would dominate the airwaves rather than AM. Now, with 235 stations, “Entercom has assumed the number-two broadcaster spot behind bankrupt iHeartMedia.”

Kippington also notes that Entercom’s advertising customers “are a diverse group and no one customer makes up a large chunk of their revenue.”

Kippington then steers the conversation toward the ever-present question, “Why radio?”

“At first blush, an investor may want to steer clear of the radio business,” Kippington admits. “After all, who wants to listen to radio when they can stream Spotify or Apple music or play their own downloaded library. But, after digging a bit deeper, it becomes clear that radio is neither dead nor dying. At worst it is stagnant due to lack of attention from advertisers. However, this should change in the future.”

That should make every radio broadcasting company quite pleased, as Kippington noted the return of Procter & Gamble Co. ad dollars to radio from digital media, which proved ineffective for the world’s No. 1 advertiser.

“The truth of radio as a medium can be found in the research done by reputable firms Nielsen and Edison Research,” Kippington adds. “Radio is unparalleled in its reach compared with other mediums, reaching over 92% of all demographics. On top of its immense reach, the radio industry has, in fact, been slightly growing weekly listeners over the past 3 years. And, in the most technologically advanced cars we have ever made, many with streaming technologies made easily accessible, people still listen to radio.”

Kippington then offers a positive quote about radio from none other than Sir Richard Branson, whose “Virgin Radio” brand can be found across Canada; in Europe across France, Italy and Switzerland; and in Dubai, among six other locales across the globe.

It notes, “Branson is quoted saying, ‘People want personality, local insight and a feeling of connection — all qualities great DJs on radio stations can share, and streaming sites can’t replicate.’ To further his point, it is highly unlikely that radio is going anywhere soon. The companies that can operate intelligently within the industry will not either … Proctor and Gamble will not be the last company to realize the inadequacies of many digital ad platforms and return to increase their spending on traditional mediums.”

Kippington then assesses Entercom by using a four-point analysis. It first asks if the broadcast company as a “competitive moat.”

It says, “It could be argued that there are not many competitive advantages to be had in the radio business let alone a competitive moat to insulate a company into the future. However, Entercom’s results would prove that it does possess sufficient competitive leverage. If a company wants exposure to the radio medium, it’s pretty difficult to avoid dealing with Entercom. To compound that, Entercom has made it its mission to compete and win in the top-50 largest markets across the country, reaching the most important populations for most advertisers. One can imagine the efficiencies that come with 112 million monthly listeners across 235 stations as opposed to iHeart’s proclaimed 250 million monthly listeners across 855 stations.”

So, what is Entercom’s competitive advantage?

Paging President/CEO David Field.

“The answer is the superb management that is disciplined in both cost and long-term mindset (most likely aided by the Field family’s ownership and, more importantly, significant voting power),” Kippington gushes. “There are many ways to see these factors at work. Entercom is well-versed in researching markets and ensuring their stations are giving consumers what they want, something that Mr. Field has stated was enormously lacking at CBS Radio. But what’s even more crucial is the fact that the company has made large format changes whenever necessary and economically feasible, lowering current revenue for a significant period until ratings are reassessed and advertisers recommit. This shows the long-term mindset that is not necessarily present at all of Entercom’s competitors.”

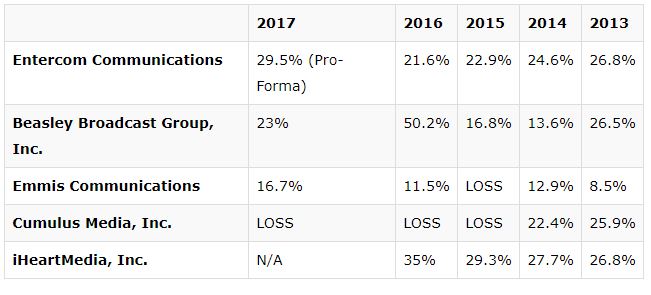

Further, Kippington says, “There’s no question management’s discipline and tightfistedness has contributed to the company’s excellent EBITDA margins with a fairly steady record and a 5-year average of just over 25%.”

The large bump in Beasley’s 2016 EBITDA margin is due in large part to a one-time $45.5 millon gain from the company’s merger with Greater Media. Absent this one-time benefit to earnings, Beasley’s EBITDA margin would be 16.9%.

A quick look at Entercom’s balance sheet by Kippington yields “no surprise” for the media industry: the company is fairly leveraged compared to the rest of corporate America.

“Though debt load is an important factor in an investment, it must be taken in context of the company’s cash flows,” it says. “It is typical of media companies to be quite tangible-asset-light but deliver significant cash.”

What’s Kippington’s conclusion?

“Entercom has been quite an out-of-favor company among investors for the past couple of years,” it says. “There are many reasons for this including the perceived decline of the radio industry due to digital disruptors like Spotify, Pandora, or Apple music as well as the bankruptcies of Cumulus Media and iHeartMedia. Fortunately for opportunistic investors, these fears as misplaced. Though radio is being disrupted, it is still a formidable force in media reaching consumers on an enormous scale. And, Cumulus and iHeart are not symptoms of an underlying disease in the radio business. They are simply reaping the results of a less-disciplined growth strategy with too much leverage.

“Investors can take comfort in the margin of safety to the fair value of the company of between $12.30 and $14.20 per share afforded in the current share price of roughly $10.25. Though shares may stumble as the company works through merger hiccups in the first half of this year, those that join founder Joseph Field in purchasing shares at these levels have the deck stacked in their favor for excellent long-term results.”

RBR+TVBR