It’s a bit of a blemish for the Mouse House, and investors aren’t pleased.

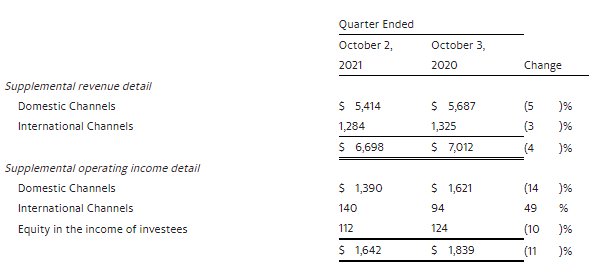

Linear Networks revenues at The Walt Disney Co. decreased 4% in the fiscal fourth quarter of 2021, moving to $6.698 billion from $7.012 billion.

At the same time, operating income decreased 11% to $1.6 billion.

That’s just part of the woes at Disney in its final three months of its 2021 fiscal year, as Disney+ subscription slowdowns were the focal point of investor concerns and those of analysts that had forecast bigger revenue for the company overall.

While international channels improved year-over-year, the domestic story is one that will be questioned.

Domestic Channels revenues for the quarter decreased 5% to $5.4 billion as operating income decreased 14% to $1.4 billion.

The decrease in operating income was due to decreases at Broadcasting and, in particular, to lower results at ABC and the owned television stations.

The decrease at ABC was due to an increase in marketing costs and higher programming and production costs, partially offset by higher affiliate revenue.

And, Disney explains that the increase in programming and production costs was driven by higher average cost of acquired programming in the current quarter, partially offset by the comparison to the additional week of operations in the prior-year quarter.

Affiliate revenue growth was due to an increase in contractual rates, partially offset by the comparison to the additional week of operations in the prior-year quarter.

ABC advertising revenue was comparable to the prior-year quarter as the comparison to the additional week of operations and the broadcast of the Emmy Awards show in the prior-year quarter was offset by higher impressions in the current quarter, reflecting more units delivered, and increased rates.

The decrease at the owned television stations was due to lower political advertising in the current quarter and the comparison to the additional week of operations in the prior-year quarter.

Overall, Disney missed the consensus estimates as compiled by Bloomberg. Revenue came in at $18.53 billion, up from $14.71 billion but shy of the $18.78 billion expected by analysts. Adjusted EPS of $0.37 was seen, rising from -$0.20. However, analysts forecasts put Disney’s fiscal Q4 EPS at $0.49.

Disney+ subscriber forecasts were also off. Disney reported 118.1 million. Analysts expected 119.6 million.

This triggered an after-hours decline for Disney shares. As of 4:54pm Eastern, DIS was off 3.33% to $168.57, following a 66-cent dip in regular trading to $174.45.

With the Opening Bell on Thursday, the bleeding deepened. As of 11:04am Eastern, DIS was down 7.6%, with a $13.17 drop to $161.28 in highly active trading. Nearly 29 million shares were trading against average volume of 8.83 million.

At the Closing Bell on Thursday, DIS was priced at $162.17, off 7%, on volume of 58.8 million shares.

Don’t miss Debra OConnell, president of Networks for Disney Media & Entertainment Distribution, on Tuesday as she co-chairs Forecast 2022.

Don’t miss Debra OConnell, president of Networks for Disney Media & Entertainment Distribution, on Tuesday as she co-chairs Forecast 2022.

For full details and to register, click here!