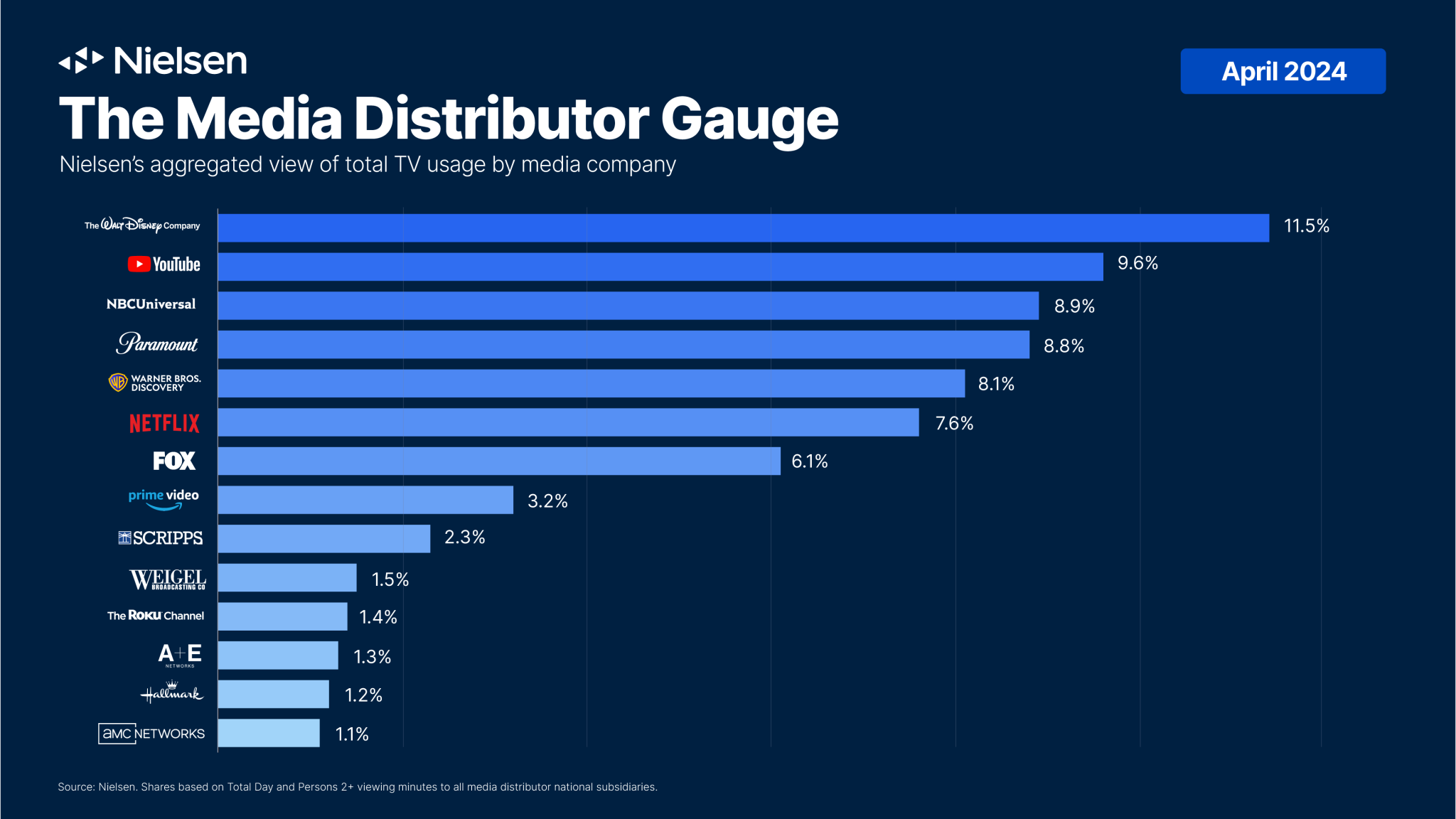

What’s being heralded as a first-ever cross-platform view of total TV consumption across broadcast, cable and streaming — aggregated and ranked by media company — is now being provided by Nielsen in a new snapshot that removes the siloes of traditional television versus streaming — just in time for the 2024 Upfronts, which more than ever include the digital story first and foremost, and the legacy linear channels perhaps secondary, depending on who you talk to.

For Nielsen, its “Media Distributor Gauge” places all content distributors on a level playing field, to allow for additional perspective of TV viewing today.

This new “Gauge” accompanies Nielsen’s April 2024 edition of “The Gauge,” and in the inaugural Media Distributor Gauge some 14 media companies achieved a 1.0% or greater share of total TV usage. The top performer in April is Disney, which accounted for 11.5% of TV viewing; 42% of its share is attributable to viewing on Disney+ and Hulu.

YouTube was the No. 2 overall company with a 9.6% share of TV in April, followed by NBCUniversal at 8.9%, Paramount at 8.8%, and Warner Bros. Discovery at 8.1% to round out the top five.

Netflix was sixth with 7.6% of TV, and the second-highest streaming distributor reported.

The debut of the Media Distributor Gauge was panned by the TVB, the broadcast television sales advocacy organization led by President/CEO Steve Lanzano and Chief Research Officer Hadassa Gerber.

The TVB pointed out that the monthly Nielsen Gauge and new Media Distributor Gauge reports do not provide “the key data” needed by advertisers: Where do consumers see their commercials?

Lanzano commented, “The Gauge reports combine all video platforms in one analysis — without separating ad-supported viewing from non-ad supported viewing — which misleads marketers into thinking their commercials can reach significantly more streaming viewers than is possible or the reality. Advertisers’ commercials are only available on ad-supported video platforms. When viewing of ad-supported platforms is analyzed alone, the results are very different from what is shown in the Gauge reports because a large number of streaming viewers do not receive ads. Advertisers need these facts when considering video media investments.”

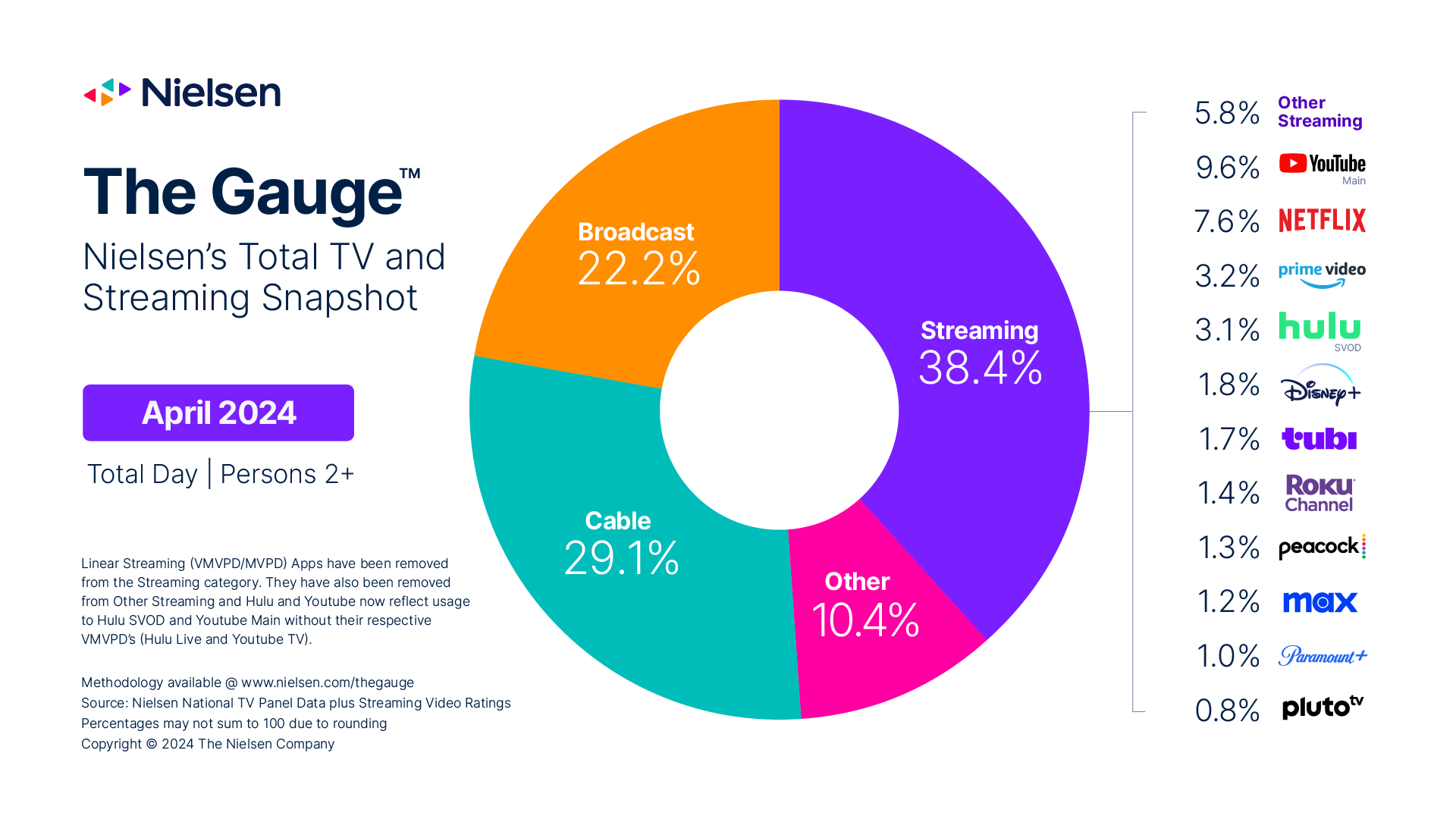

Meanwhile, the April 2024 edition of “The Gauge” offers a somewhat somber look at broadcast TV consumption compared to that of cable and of streaming.

With Amazon Prime Video getting attention for its debut of the sci-fi action apocalypse series “Fallout,” time spent watching TV was fairly flat both month-over-month (down 2%) and on an annual basis (down 0.6%).

That said, Nielsen finds broadcast TV viewing was down 3% in April, which equated to a 22.2% share of TV.

If it weren’t for women’s sports, the viewer totals would likely have been less; the drama genre accounted for 29% of broadcast viewing, driven by Tracker, NCIS and Young Sheldon on CBS, and Chicago Fire and Chicago Med on NBC.