S&P Global Market Intelligence has computed its data for North American media and telecom companies’ mergers and acquisitions for the month of February, and it has tallied 96 deals valued at $160 million.

That, S&P Global says, is the sector’s softest showing in M&A activity in 13 months.

And, when looking at January 2023, there were more deals — just at a lower total value.

This is the sector’s weakest showing in M&A activity since January 2023, when there were 142 deals with an aggregate value of $65.7 million, says S&P Global.

It also represents a sequential drop from the $1.84 billion generated from 98 transactions in January 2024, S&P Global adds.

Even though that news is glum, there could be a bright spot for some:

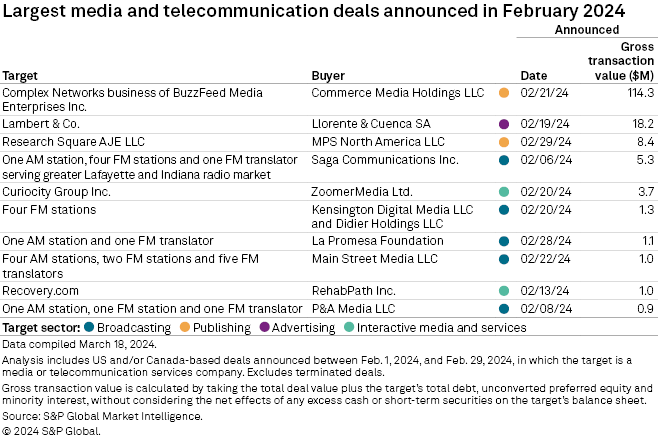

- Five of the month’s top 10 transactions involved the purchase of radio stations.

The radio industry deals were led by Saga Communications‘ announced $5.3 million purchase of WKOA, WKHY, WASK, WXXB and WASK, along with FM translator station W269DJ, from Neuhoff Communications.

Kalil & Co. was the exclusive broker for the deal, which awaits FCC approval.

The other radio deals involve Kensington Digital Media of Nashville; P&A Media LLC; and Main Street Media LLC — small regional operators.

Meanwhile, a notable Canadian deal sees the Moses Znaimer-led ZoomerMedia Ltd. make a $3.7 million USD bid for Curiocity Group Inc. in a deal announced on February 20.

Over the last 13 months, two stick out as being particularly strong for deals: April and November 2023.