LAS VEGAS — For forty years, Robert Heymann has served as a media broker, helping buyers and sellers complete transactions with values ranging from $11,000 for an Indiana low-powered TV station to the $165 million deal that created Classic Rocker “The Drive” in Chicago.

Given his experience with transactions, born out of his ownership of an FM radio station in San Francisco in the early 1980s, what does Heymann have to say about the deal-making environment of today and its overall health? The assessment is hardly rosy.

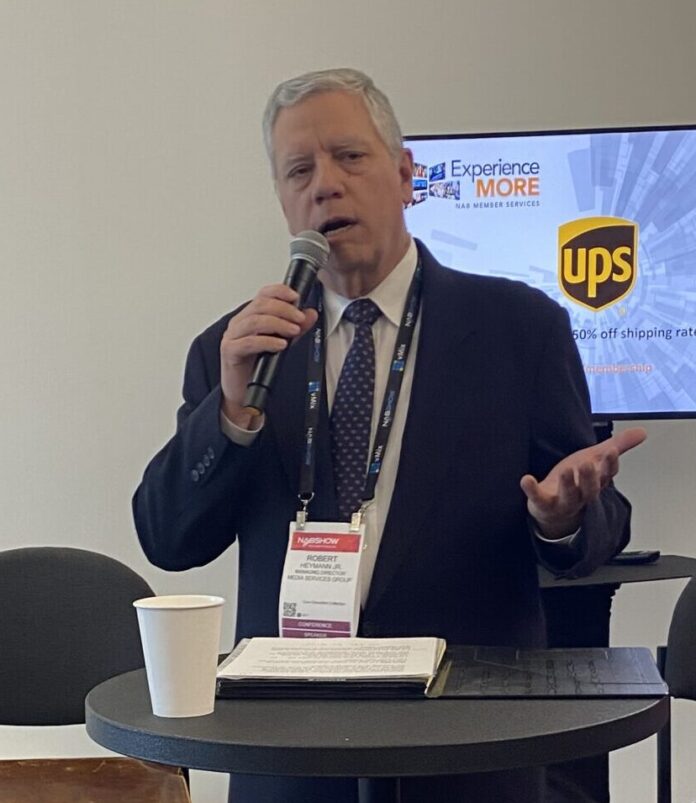

Heymann offered his appraisal of the broadcast media marketplace of 2024 in a “Discussion Den” session at the 2024 NAB Show. Unlike a traditional panel session meeting room, Heymann offered his chat in an informal setting with a smattering of chairs, resulting in an over-capacity crowd eager to hear his thoughts on where radio and TV station deals are heading.

He started with a review of publicly traded radio companies, and how the biggest ones aren’t doing particularly well financially. TV? It’s not much better, he said, referring to the current stock market activity for broadcast media companies trading on the Nasdaq, NYSE and OTC markets.

Heymann then reviewed the year in deals before turning to what, in his view, is driving lackluster deal valuations. His first reason? “Lack of revenue growth.” He passed around print-outs indicating BIA Advisory Services trends for the next few years. For radio, “there is not one year with an increase in radio revenue,” Heymann said. For 2024, revenue is projected to dip by 2.4% In 2028, revenue is forecast to be down 3%. Plus, Heymann added, “You can be certain there will be inflation over the next few years, which will cut into the cash flow.”

TV, in contrast, is forecast to see “modest” revenue growth. Still, Heymann cautions, that’s nothing to write home about as private equity and venture capitalists are looking to companies like Nvidia and Meta with respect to revenue growth as investment comparisons.

Other reasons, Heymann believes, include the lack of any meaningful FCC regulatory relief, and the “overwhelming amount of competition for broadcast media.

What, then, should a broker do when engaging with a broadcast media company that has a radio station or cluster of stations it wishes to divest? Setting the asking price is Task No. 1, Heymann advises. “Some stations will take any price,” he told the crowd, which included representatives from Midwest radio station groups. “We will not do this. If I cannot give a definitive answer to a prospective buyer, it says the seller is not serious about selling a station or cluster.”

Therefore, a reasonable asking price is paramount, and that comes through “part science and part art” while looking at market comparables. Lastly, marketing the station’s availability is an important part of finding the right buyer.

Asked by RBR+TVBR about access to capital, a continued concern of significance for those that may be potential first-time buyers, Heymann considers the two best sources for Radio to be the “local bank where you have a relationship,” and “Seller Paper,” which can be a Promissory Note and obligation. Otherwise, he said, “that’s it for radio.”

With those tasks, Heymann concludes that, if a station deal is the ultimate goal, to be “as reasonable as possible to generate legitimate interest.”