The audio content creation and distribution company known as Audacy Inc., which has seen severe fiscal challenges over the last two years and today trades as an Over the Counter issue valued at just 35 cents per share, released its third quarter results on Thursday. Once again, President/CEO David Field and CFO Rich Schmaeling declined to host a conference call; a press release was posted to Business Wire and submitted with the Securities and Exchange Commission highlighting another disappointing three-month period for the company formerly known as Entercom.

DIGITAL GROWTH CAN’T OFFSET NATIONAL WEAKNESS

If there’s any glimmer of hope for Audacy shareholders that growth is in the forecast, it could lie within the company’s Digital arm. Revenue was up 3% from Q3 2022, totaling $64.8 million.

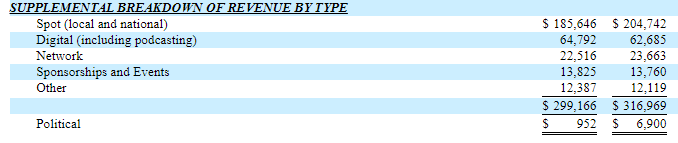

But, like peers including iHeartRadio, that’s just a fraction of the total $299.2 million in revenue Audacy reported for Q3 2023, falling from $317 million year-over-year.

Just one analyst tracks Audacy, and they predicted revenue of $301.3 million for the company.

While station expenses fell to $255.69 million from $259.9 million, corporate expenses grew to $32.11 million from $21.14 million. Then, there is a non-cash impairment charge reflecting the diminished value of radio stations compared to when Audacy acquired them. In Q3, a $272.66 million impairment charge was taken, up from $176.78 million a year ago.

Put it all together, and Audacy in Q3 widened its net loss to $234.33 million (-$49.64 per share), from $140.98 million (-$30.35). Adjusted EBITDA for the quarter was $23 million, compared to $36.3 million in Q3 2022.

Political advertising was somewhat of a factor, as it dropped to $952,000 from $6.9 million in the quarter.

However, the breakdown of revenue by type for Q3 2023 (in the left column), compared to one year ago (in the right column), shows how significant local and national spot advertising is for Audacy.

As the company summarized in its earnings release, Local spot revenues were down 3%, National spot revenues were down 15% and Network advertising revenues were down 5%.

MORE DOWNWARD MOVEMENT AHEAD

In comments shared in his company’s earnings release, Mr. Field shared that Q4 is currently pacing down 9% on an as-reported basis and down 4% on a same-station, ex-political basis. “We expect Q4 total revenues to decline by high single digits and costs to decline by high single digits,” he said.

DEBT RESTRUCTURING EXPERT WELCOMED TO BOARD

The Q3 earnings release came one day after Audacy shared with the SEC in a separate filing that its Board of Directors on Tuesday agreed to expand from eight to nine members, welcoming Roger Meltzer as a Class II director who will be seated through the company’s 2025 shareholders meeting.

“Meltzer has substantial experience serving as a director of entities that considered potential alternatives regarding debt restructurings,” the company said in a filing submitted Wednesday to the SEC.

And, Meltzer’s bigger role with Audacy has been appointed to a newly created Special Review Committee — comprised of Meltzer and no one else. “The Special Review Committee is vested with the authority to conduct or authorize reviews into any matters germane to the potential restructuring of the company as it deems appropriate,” Audacy said in the filing.

Meltzer will not only be paid for his role as a non-employee director per Audacy’s compensation policy but will also receive $28,334 per month for his role as the Special Review Committee chairman and sole member. This committee fee will be paid in advance, with the first payment covering the first two months of service.

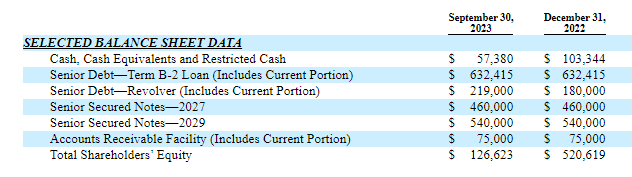

While writing a check to Meltzer in the amount of $56,668 should not normally be of concern to a company the size of Audacy, its cash on hand is. This explains why Audacy on November 3 entered into its eighth amendment to its credit facility with JPMorgan Chase Bank, a move that allowed Audacy to extend its three-day business day grace period on a $17 million interest payment to a total of 11 business days from October 31, 2023.

This extension include a $785,592 payment that had been due on November 8. Furthermore, the credit facility amendment waives the requirement for Audacy to comply with its maximum Consolidated Net First Lien Leverage Ratio for the quarterly test period ended September 30.

As of September 30, the company’s liquidity, which includes restricted cash, was $57.5 million.

Commenting on the company’s fiscal health, Field said, “We remain in constructive conversations with our lenders to recapitalize the company’s balance sheet to establish a strong financial footing and position the company to capitalize effectively on our growth opportunities. Notwithstanding current challenges, Audacy has established a strong position as a scaled, leading multi-platform audio content and entertainment company distinguished by our exclusive premium content and top positions across the country’s largest markets. We salute our team for their strong work delivering solid growth against our key performance metrics and serving our listeners and customers with excellence.”

![FCC Chairwoman Heads To Storm-Battered North Carolina A storm-damaged home in the town of Newland, N.C. near Banner Elk. [Photo: Mindy Kent/Facebook]](https://rbr.com/wp-content/uploads/Banner-Elk-Mindy-Kent-218x150.jpg)