Just how fiscally risky is a protracted retransmission consent between Charter Communications, owner of the Spectrum MVPD, and The Walt Disney Company?

According to a S&P analysis, billions of dollars in annual revenue is at stake.

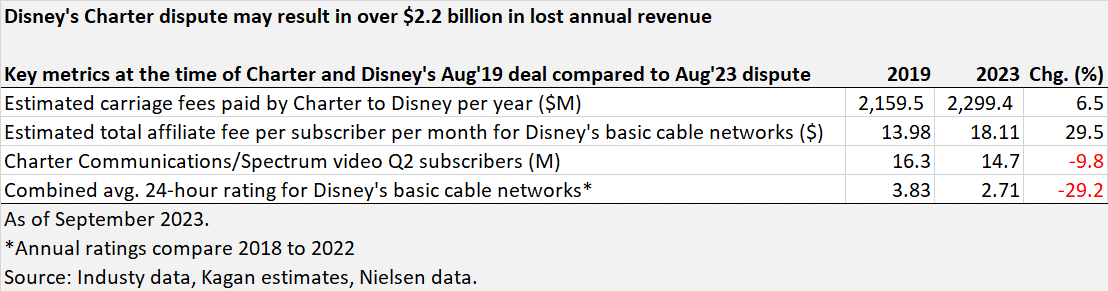

S&P Global Market Intelligence used Kagan 2023 basic cable network license fee estimates and first-quarter 2023 Media Census subscriber estimates to calculate the annual amount that Charter is paying Disney to carry its stable of basic cable networks.

“We estimate that Charter’s carriage payment obligations to Disney are just under $2.3 billion in 2023,” it reveals. “This has grown from an estimated $2.16 billion in 2019, when Charter and Disney last renewed their carriage agreement.”

As shown below, the dollars going to Disney have increased while “cord-cutting” woes and viewership of Disney’s cable networks have each decreased over the same period.

That’s a serious conundrum for Disney, as Kagan estimates show that the price Charter is paying for the 17 Disney-owned basic cable networks has grown at an average annual rate of 6.7% from 2019 to 2023 — making the 2023 fees 29.6% higher than the 2019 fees.

As has been reported, ESPN is the highest-priced network in the cable TV sphere, and for Charter it comes at an estimated cost of $9.42 per subscriber per month.

“The network can demand a lofty price because of its high-priced sports media rights deals,” S&P Global Market Intelligence notes. However, Disney has begun shifting sports rights to its ESPN+ streaming service, which market observers including Brian Wieser of Madison & Wall and Michael Nathanson of MoffettNathanson have each called out critically.

S&P also echoes their concerns about Disney possibly bringing on a strategic partner to bring the linear ESPN network direct-to-consumer, “which would devalue its importance in traditional cable bundles and potentially spur additional cord-cutting.”

Thus, the carriage dispute between Charter and Disney “highlights an industry undergoing a challenging transition from linear to streaming,” S&P Global Market Intelligence concludes. “While both companies are invested in making these relationships work, there are obvious pain points that might result in changes to the status quo. If Disney makes concessions on pricing, it has the potential for other programmers — such as Paramount Global and Warner Bros. Discovery Inc. — to lose negotiating leverage with operators moving forward and be forced to accept lower rates for the linear networks. On the flip side, if Charter agrees to Disney’s demands, smaller operators might be put in a position to abandon video altogether as the margins no longer make sense. While we do believe that a deal will eventually be reached and Disney’s channels will return to Charter’s lineups, the impact of the dispute has the potential to alter future carriage negotiations across the industry.”