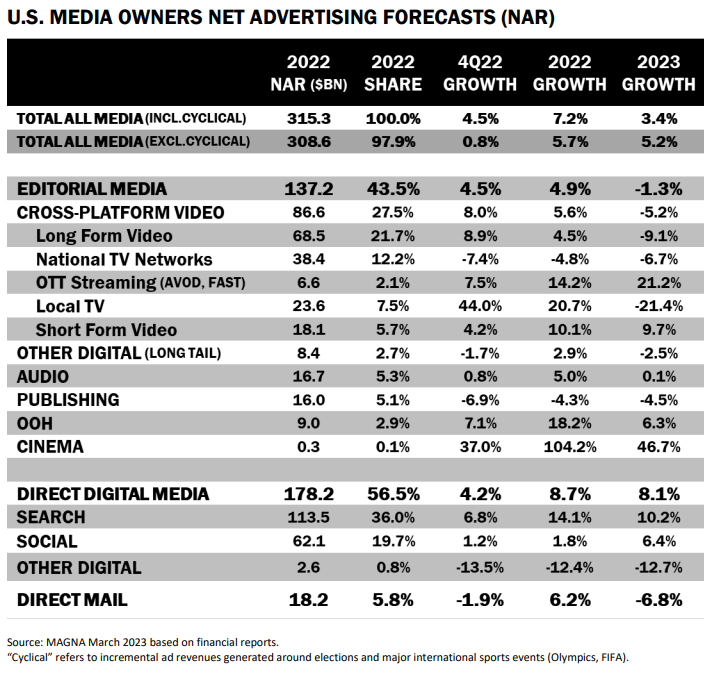

U.S. media owners’ advertising revenues grew by a “decent” 6% in 2022, excluding cyclical ad spend, to reach $315 billion. However, there’s an important footnote surrounding just how that growth was achieved.

According to MAGNA, ad spend slowed down “significantly” through the second half of last year, as fourth quarter ad sales were flat year-over-year.

What’s the forecast for 2023? It’s lower than MAGNA’s previous outlook, and “the decline of linear TV” is a takeaway that can’t be ignored even as Automotive “has finally turned a corner.”

With mixed economic signals greatly influencing businesses and consumers, the growth of ad-supported video streaming — coupled with a long-awaited Automotive comeback — that macroeconomic uncertainty is lessened.

Still, ad categories including Consumer Packaged Goods — perhaps those from brands that compete against Procter & Gamble Co. — “might struggle.” The same is said by MAGNA of Restaurants and Retail as inflationary trends could curb discretionary spending.

This explains why MAGNA anticipates all-media ad revenues to increase by 3.4% this year, instead of by 3.7% as previously predicted for 2023.

Even with the slightly lower prognostication, the market will grow to a new all-time high of $326 billion.

Neutralizing cyclical events in 2022 and 2023, non-cyclical advertising spend (excluding political and Olympic) will grow by 5.2% this year.

However, that’s no reason for “linear” media such as broadcast radio and television to cheer. These linear advertising formats, “more vulnerable to the uncertain economic environment,” will erode by 4%, MAGNA predicts.

With iHeartMedia and Beasley Media Group suffering from historic lows with their publicly traded stock and Audacy Corp. shares at just under 11 cents as of 11am Eastern on Monday, the MAGNA report only exacerbates the story of continued “headwinds” for AM and FM radio station owners.

In contrast, digital advertising growth is forecast to be at 9% for 2023, “as growth in OTT

ad sales will offset the decline of linear TV.”

While that’s glum news for broadcasters, MAGNA EVP/Global Market Research Vincent Létang believes things are different in 2023 because of media innovation fueling marketing demand.

“In a similar economic climate, 10 or 20 years ago, the U.S. advertising market would almost certainly fall off a cliff,” he said. “The organic drivers that boosted the ad market in 2021 and the first half of 2022 are still around and mitigating the impact of stressful economic signals.”

Such organic drivers include the rise of retail media networks, which are redirecting billions of marketing budgets dollars into advertising formats. “In addition, with long-form OTT

streaming going mainstream and increasingly ad-supported, brands finally find cost-effective solutions to reconnect with audiences that had become hard and expensive to reach through linear television,” Létang said.

Meanwhile, while the second-half slowdown is notable as is the Q4 2022 flat-as-a-flapjack ad growth, MAGNA notes that tough comps to 2021 are at play, with a post-COVID year that was the strongest ever, both in terms of dollar spend and year-over-year growth. “With such high comps MAGNA was always expecting a significant slowdown following this abnormal year of growth,” Létang said.

MODEST MOVEMENT UPWARD

In its new 2023 scenario, MAGNA expects little or no growth in the first half (2% in Q1, 4% in Q2) against tough quarterly comps, followed by a recovery in the second half (6%-7%) as the economy solidifies and advertising comps become much easier.

Overall, full-year advertising revenues will grow by 3.4% this year to reach $326 billion.

And now, the sour news. “Local television may struggle with non-political ad sales down 5% and total ad revenues might shrink by 24% due to the lack of political spending, after record sales in 2022,” MAGNA shared.

What about Radio? “Linear radio ad formats will drop 4%, while digital audio formats (audio streaming, podcasting) will rise 9%.”

Again, it is all about Digital, as Podcasting will grow 16%.

Great, right? Not entirely. Although this represents a slowdown compared to MAGNA’s previous forecast of 22%, “the channel has not been immune to the general

advertising market slowdown, despite continued interest and adoption.”

The next MAGNA ad forecast (U.S. & Global) will be published in June 2023.