One of the world’s most dominant audio content on-demand platforms on Tuesday revealed its Q4 2023 results. They didn’t meet analysts’ expectations. However, Spotify‘s guidance for what’s to come has excited investors, sending its stock price up by nearly 5% in midday activity on the NYSE.

For Pivotal Research Group CEO and Internet, Media and Communications Analyst Jeffrey Wlodarczak, the forthcoming quarters are so rosy that he reiterated his “Buy” rating on “SPOT” while significantly hiking his year-end target price to a value nearly $100 per share higher than where it started today’s trading session.

The Zacks Consensus Estimate for Spotify in Q4 2023 was for earnings per share of $0.08.

Instead, Spotify reported a quarterly loss of -$0.39 per share.

Bad, right? Not exactly, as Spotify did reduce its loss from -$1.43 in Q4 2022.

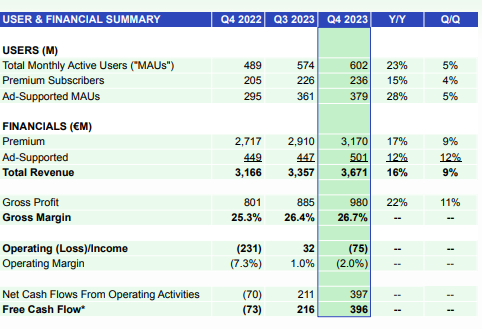

Additionally, while Q4 2023 revenue was slightly below the Zacks Consensus Estimate, coming in at $3.95 billion, that’s up from $3.23 billion; the values were converted from Euros, the currency in which Spotify reports its results.

Also benefiting Spotify, which just signed podcast star Joe Rogan to a fresh deal reportedly valued at $250 million, are user and subscriber counts that came in ahead of expectations in Q4.

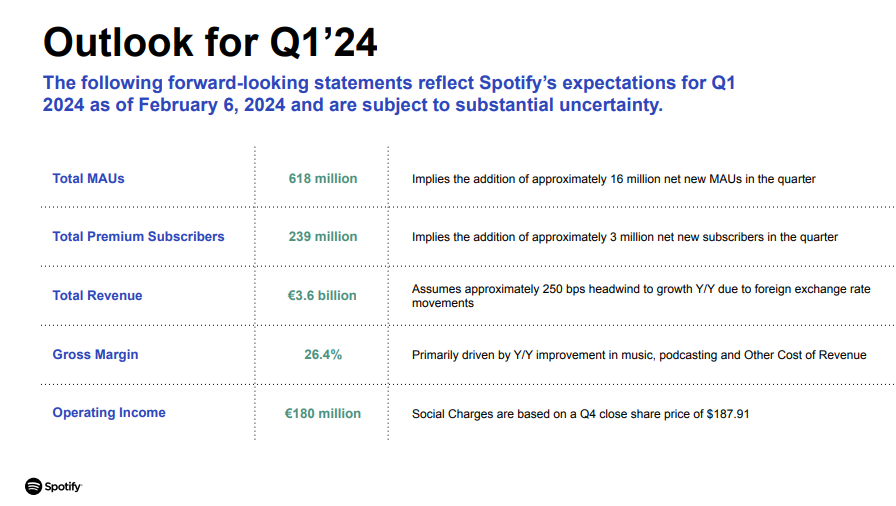

Then, there’s the guidance. “With revenue and profitability trends both inflecting favorably heading into 2024, we view the business as well positioned to deliver improving growth and

profitability,” Spotify reported in an investor deck distributed before its 2pm CET call on Tuesday.

The results led Wlodarczak to propel his year-end 2024 target price for Spotify to $330 while reiterating a “buy” rating.

This increases Pivotal’s target price for “SPOT” from $265, which is noteworthy as Spotify as of 12:25pm Eastern was up 5.1% to $234.72.

To say Wlodarczak is wild on Spotify may be no exaggeration.

“The stronger than expected financial outlook (and likely a new efficiency focused CFO once Paul Vogel departs in March) is in-line with our positive investment thesis that Spotify is poised to see a massive ramp in free cash flow,” he writes in an investor note. “Importantly, this appears to be happening at a faster than expected pace.”