The “Cumulus Media New Holdings Inc.” subsidiary of the Atlanta-based audio content creation and distribution company helmed by Mary Berner has moved ahead with an exchange offer that pushes out the publicly traded company’s debt by three years.

By doing so, however, Cumulus Media is agreeing to a two percentage-point hike in its interest rate.

The move means Cumulus Media New Holdings Inc. on Tuesday (2/27) turned the light switch on for an offer to exchange its outstanding 6.750% Senior Secured First-Lien Notes due 2026 for new 8.750% Senior Secured First-Lien Notes due 2029.

The new notes will be issued by the Cumulus subsidiary upon the terms of and subject to the conditions set forth in a confidential offering memorandum and consent solicitation statement released Tuesday.

The offer expires at 5pm Eastern on March 26.

All capitalized terms not defined herein are defined in the company’s offering memorandum, unless otherwise noted.

The new notes will mature on March 15, 2029 and will be fully and unconditionally guaranteed on a senior secured basis on the same basis and by the same guarantors that guarantee the old term loans and the old notes.

A GUARANTEED LOAN EXTENSION?

The offer to Cumulus’ debt holders isn’t exactly a fait accompli.

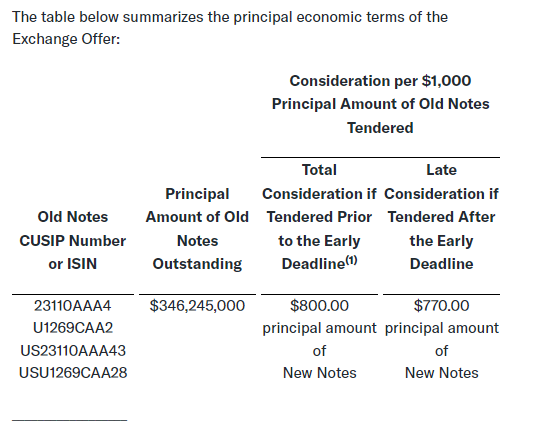

Holders that validly tender and do not validly withdraw their old notes at or prior to 5pm Eastern on March 11, the “Early Tender Time”, will be eligible to receive $800 principal amount of the new notes per $1,000 principal amount of the old notes tendered.

While this includes an early tender premium of $30 in principal amount of the new notes for every $1,000 principal amount of the old notes tendered, there could be some holdouts that may not wish to agree to those terms.

For holders who procrastinate, however, they’ll receive only $770 principal amount of new notes.

If consents from holders representing at least 66.67% of the old notes are received, all the collateral securing the old notes will be released.

That said, if consents from holders representing at least 50.1% of the old notes are received, the elimination of “substantially all restrictive covenants,” along with certain events of default, would transpire, allowing the debt swap to move ahead.

NEW TERM LOANS DETAILED

An exchange of old term loans for new term loans is also in the works at Cumulus. At least 50% participation is required for this to transpire.