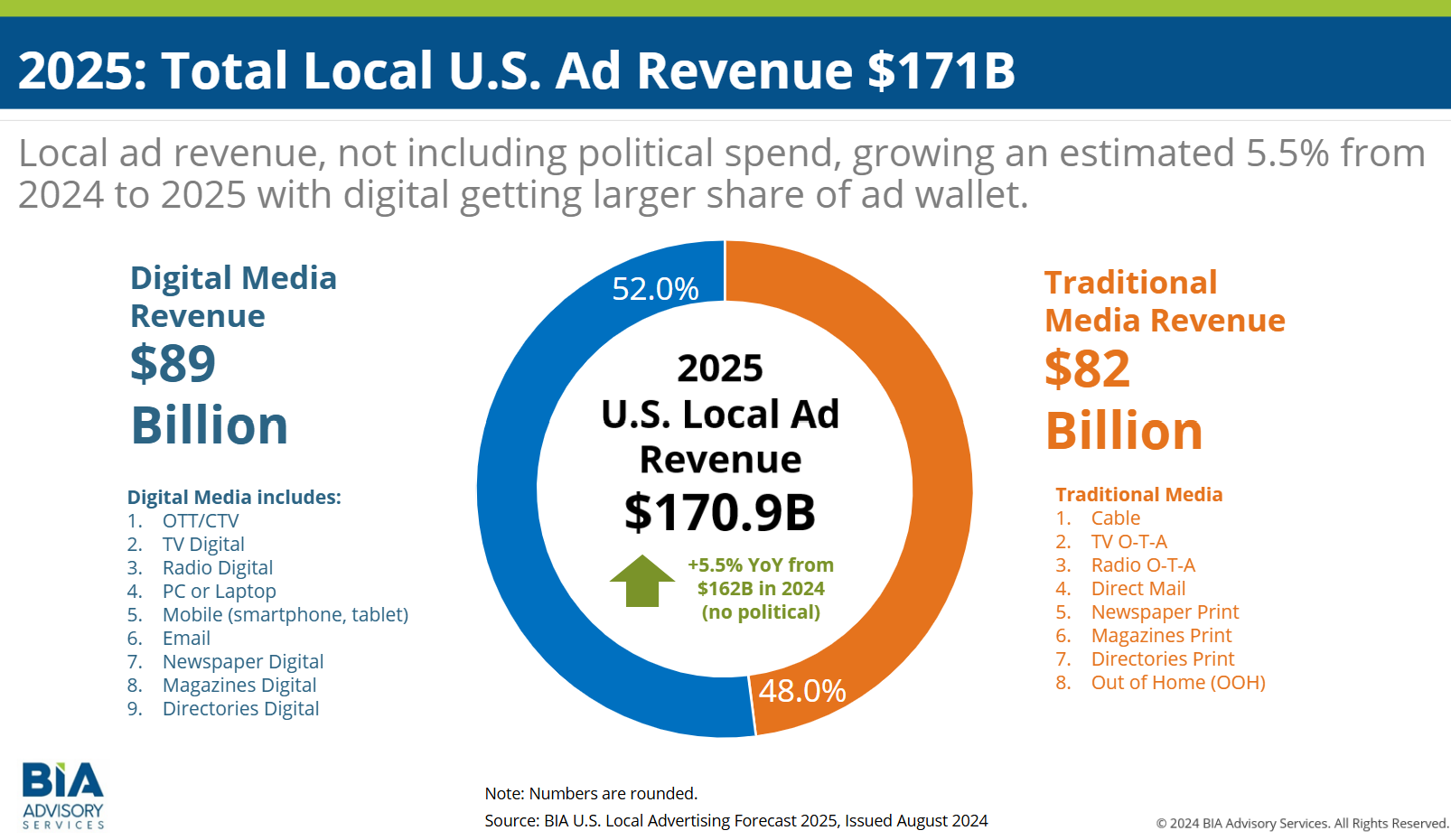

BIA Advisory Services early Wednesday released its first look at its 2025 total U.S. local advertising projections and believes revenue will reach $171 billion next year — a rise of 5.5% on an ex-political basis.

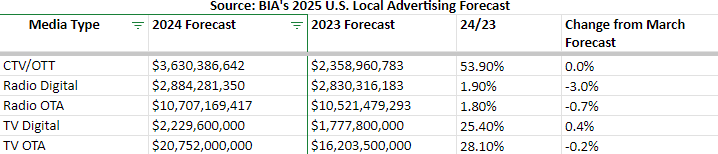

At the same time, BIA adjusted downward its 2024 forecast for over-the-air television, in addition to both digital and linear radio, based on new expectations as it reviews the Political ad-dollar flow to all local media.

The big truth, which some industry trade publications have clouded with tales of robust local media dollar growth, is that Connected TV and OTT are fueling the uptick in revenue projections.

As BIA sees it, a stunning 53.9% growth in local advertising for Connected TV and OTT is anticipated for FY 2024, growing to $3.63 million from $2.34 million.

Concurrently, Digital Television local ad growth is now forecast to rise by 25.4%, a revision from 25% in an earlier BIA forecast. This puts the total at $2.23 million for 2024, up from $1.78 million in 2023.

Over-the-air television? The not-so-pleasant news is that total 2024 local ad revenue for broadcast channels is now forecast to grow at 28.1%, down from 28.3% growth in an earlier BIA forecast. Still, over-the-air television is poised to see local ad revenue this year totaling $20.75 million, rising from $16.2 million. And, given the extreme macroeconomic factors impacting multiple industries, a sliver of a decline could be incidental for many broadcast TV station ownership groups.

The bigger and more omnipresent challenges are at Radio, as BIA’s updated forecasts are troublesome for the industry’s bigger, publicly traded companies. Digital radio advertising is now expected to grow by 1.9% — compared to 4.9% as noted in an earlier BIA 2024 forecast. At the same time, Over-the-Air local radio advertising is anticipated to increase by 1.8% in 2024, a downward revision from 2.5%.

BIA Advisory Services VP of Forecasting and Analysis Nicole Ovadia commented, “We’ve refined our projections for local advertising, both with and without political advertising, to better reflect anticipated overall media spend and to offer a view in the advertising marketplace from different perspectives.”

While the data above confirm local television continues to get the largest share of the spending, Connected TV/Over-the-Top (OTT) will receive much of the additional political ad dollars added to the mix, BIA forecasts.

EX-POLITICAL DOLLAR UPTICK AHEAD

While Radio will see tempered growth, it’s better than a downturn. But, what will 2025 look like for the five local media segments BIA examined?

The projected revenues across all local media in the U.S. will reach $171 billion in 2025. “This represents an increase of 5.5% in non-political spending over our revised 2024 estimate,” BIA says.

The important factor: When including political advertising, the 2025 estimate of $171 billion represents a 1.3% decline from the revised estimate of $173.7 billion for 2024.

In this forecast, BIA raised its 2024 local advertising estimate to $11.7 billion — primarily due to an expectation of increased political advertising of $560 million.

Explaining BIA’s first crack at 2025 expectations, Ovadia said, “We are taking a nuanced view to shape our expectations. If the Fed adjusts interest rates as indicated, post-Q1 2025

or early Q2, and inflation cools and the labor market settles out, we anticipate some

economic relief by mid-year. This will boost consumer confidence and, subsequently,

increase media ad spend. While we are optimistic, we are also being cautious with our

projections at this early stage.”

Growing media in the forecast without political for 2025 include PC/Laptop

(+13%), Connected TV/OTT (+9.1%), Out-of-Home (+5.9%), and TV Digital (+5.4%).

BIA Managing Director Rick Ducey commented, “In previous forecast rounds, we reported robust growth in Connected TV/OTT, but different factors have led us to moderate expectations around the speed of that growth. One factor is that while streaming viewing is growing, there’s less available ad minutes in streaming versus linear TV. However, this channel continues to present valuable opportunities for advertisers due to how it combines the power of premium TV with the precision of digital audience targeting. Political and issue campaigns are tapping into this capability, and it will be interesting to unpack the use cases and outcomes.”