Just what do Gray Television investors think about the company’s second quarter earnings results, released Friday morning?

Simply take a look at the company’s stock performance. At Friday’s Closing Bell, “GTN,” which trades on the NYSE, was up by more than 20% from Thursday’s close.

There’s one big reason why, and it has everything to do with core ad prowess.

So, just how well did Gray Television perform in the three-month period ending June 30?

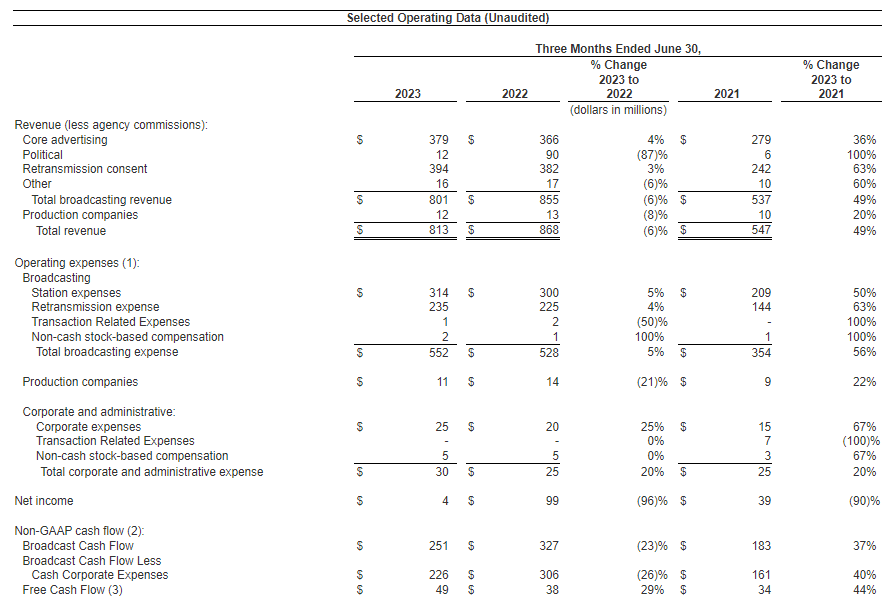

For starters, Free Cash Flow grew to $49 million from $38 million as the company, on difficult comps due to lingering macroeconomic headwinds and strong Q2 2022 political ad revenue, squeaked out net revenue of $4 million, down from $99 million one year ago.

With Gray’s total leverage now at 5.38x, the company’s overall revenue in Q2 ’23 slipped by 6%, to $813 million from $868 million.

However, a closer look at the revenue seen by Gray in the quarter reveals perhaps something extraordinary, compared to peers TEGNA and Scripps: Core advertising revenue for Gray grew by 4%, to $379 million from $366 million.

The increase in ad revenue, combined with a 3% increase in retransmission consent revenue to $394 million from $382 million, greatly helped in offsetting a 87% cyclical decline in political ad revenue, which declined to $12 million from $90 million.

With co-CEO Hilton Howell Jr. joined by Chief Legal and Development Officer Kevin Latek, co-CEO Pat LaPlatney and newly appointed EVP/COO Sandy Breland hosting Gray’s call, Howell assessed Gray’s stellar quarter simply.

“We beat on core advertising revenue, we beat on retransmission revenue, we beat on political advertising revenue, we beat on EBITDA, and we beat on Free Cash Flow,” he shared.

Automotive also continues to “recover strongly” for Gray, Howell noted; a 20% year-over-year increase was seen, fueled by even larger increases year-over-year in the national segment of that category. But, overindexing on political advertising dollars — even with the tough comps — is another achievement Gray’s C-suite can revel in. “This confirms that our television station portfolio is delivering the strong content our viewers want,” Howell said.

Additionally, Gray leaders noted that construction on the Assembly Studios portion of Assembly Atlanta and much of the infrastructure for the entire project is now substantially complete, and main tenant NBCUniversal has begun moving into its leased production facilities even as a WGA and SAG-AFTRA concurrent work stoppage has crippled lensing of new shows.

Just how stellar were Gray’s beats?

The $813 million in revenue soared past the high estimate of $800 million offered by one of 7 analysts polled by Yahoo! Finance.

With total broadcasting expenses rising 5% to $552 million from $528 million, Gray’s Q2 earnings per share attributable to common shareholders came in at -$0.10 per diluted share, compared to $0.91 in the second quarter of 2022.

This soared past the -$0.18 consensus estimate offered by the 7 analysts polled by Yahoo! Finance.

GTN finished Friday’s trading session at $10.50. This returns GTN to its highest values since the first days of March 2023.

GRAY BOARD OKs DIVIDEND

Gray Television’s Board of Directors has authorized a quarterly cash dividend of $0.08 per share of its common stock and Class A common stock. The dividend is payable on September 29 to shareholders of record at the close of business on September 15.

Guidance for the Three-Months Ending September 30, 2023

Based on Gray Television’s current forecasts for the third quarter, it anticipates the following key financial results, as outlined below in approximate ranges. Gray presents revenue net of agency commissions and excludes depreciation, amortization and gain/loss on disposal of assets from our estimates of operating expenses.

-

Revenue:

-

Core advertising revenue of $360 million to $368 million, flat to up low single digits.

-

Retransmission revenue of $370 million to $380 million.

-

Political advertising revenue of $15 million to $16 million.

-

Production company revenue of $18 million to $19 million, including, as discussed below, the impact of the rejection of the Diamond Sports Group, LLC’s (“Diamond”) Atlantic Coast Conference (“ACC”) contract with our Raycom Sports subsidiary and its replacement with a new ACC sports rights agreement with the CW Network (“CW”)

-

Total revenue of $780 million to $801 million.

-

-

Operating Expenses:

-

Broadcasting expenses of $565 million to $575 million, including retransmission expense of approximately $235 million and non-cash stock-based compensation expense of approximately $1 million.

-

Production company expenses of approximately $18 million to $19 million, excluding, as discussed below, the non-cash impairment charge.

-

Corporate expenses of $30 million to $35 million, and non-cash stock-based compensation expense of approximately $4 million.

-