Piper Jaffray has completed its 27th semi-annual Taking Stock With Teens market research project, which signals a potential point of stability, with spending contracting by just 1% from Fall 2013, compared to sequential declines in the mid-single digits previously.

Piper Jaffray has completed its 27th semi-annual Taking Stock With Teens market research project, which signals a potential point of stability, with spending contracting by just 1% from Fall 2013, compared to sequential declines in the mid-single digits previously.

“Over the 13-year history of our survey, we have observed notable changes in the brands teens aspire to own and wear, the influences that direct what they buy, and how teens are consuming, interacting with and sharing the brands they love,” said Steph Wissink, co-director of investment research and senior research analyst at Piper Jaffray. “The universal truths about teens remain the same—they continue to seek peer affirmation, their spending is almost entirely discretionary, and they are early adopters of change. What’s different about this generation of teens versus prior is that they are non-conformists, they seek experiences over products, and they align with brands that are practical yet cool.”

Key findings from the survey in fashion, beauty and personal care, restaurants, digital media, gaming, and wireless communication include the following:

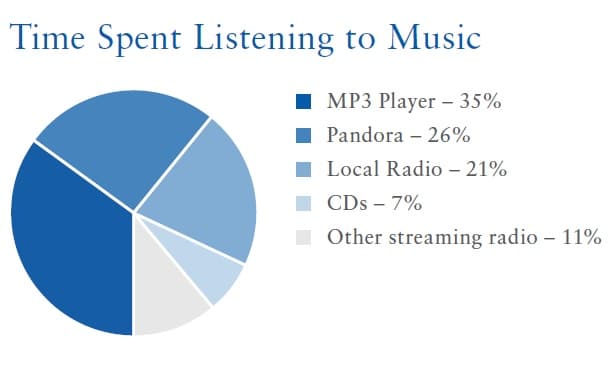

–Music/radio listenership has grown for Pandora and local radio, largely at the cost of MP3s and CDs.

–Teen males indicated they were spending more, up 4% from Fall 2013, which has historically signaled inflection in broader spending

–For the first time in their survey history, food exceeded clothing as a percentage of the teen wallet. Electronics also gained in share, while furniture and fashion ceded modest share.

–Declines in the fashion category were most severe in accessories– down double-digits for a second cycle in a row

–Top clothing brands (continued to) include Nike, Action Sports, Forever 21, American Eagle, Polo Ralph Lauren and Hollister

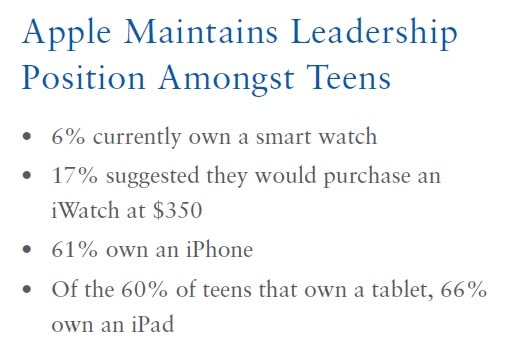

–17% of teens expressed interest in an Apple iWatch, up 12% from Fall 2013, which we believe is an indication of consumer appetite

–Instagram ranked as the most important social network, exceeding Twitter and Facebook for the first time in survey history

–At home, cable subscriptions are becoming less essential for teens, while online streaming is more critical. Out of home, IMAX continues growing share among teens.

–85% of teen gamers play mobile games.

More in-depth findings:

- Men’s Turning First; Historically a Sign of a Broader Spending Inflection

Across both our upper and average income groups, teen males indicated they were spending more sequentially, up 4% from Fall 2013. This compares to continued mid-single digit declines among females. - Things Experienced Versus Things Worn; This Generation of Teens Are “Doers”

Recognizing that few teens are the grocery buyers in their household, we see the food category representing restaurants and dining out. We also observed a modest increase in wallet share devoted to events (including concerts, festivals, etc.). Within the fashion wallet, clothing increased modestly at the expense of footwear and accessories. And we noted the continuation of a lifestyle/participation-based trend in fashion athletic. We think off of these data points are evidence of a trend toward experiences versus items worn and a notable shift in perceived status spending. - Clothing Spend Stabilizes; Footwear Cycle Extended; Accessories Spending Declines

Within the fashion category, the declines were most severe in the accessories classification – down double-digits across genders and income classes for a second cycle in a row. Spending on apparel stabilized at flat sequentially for upper income teens and down 2% for average income teens. Spending on accessories declined 22% among upper income and 26% among average income teens on a year over year basis. The footwear cycle appears to be extending as spending on shoes increased 1% sequentially among upper income teens and declined just 1% among average income teens – a category of relative outperformance across income profiles. Intent to spend contracted across fashion categories to the prior year, but expectations around spending on footwear improved sequentially. - Fashion “On Demand;” Shopping Frequency Stabilizes Following Low Mark in Fall 2013

Shopping frequency has declined from a peak rate of 38 trips/year to 29 trips/year (one every 1.75 weeks). We note Fall 2013 appears to have marked the low point at 28 trips. Our measure of trip frequency improved 2% sequentially, although still down 10% year over year. We estimate mall traffic in the teen space has declined 30% cumulatively in the last 10 years. It’s increasingly evident that teens are browsing more often via their mobile devices, shopping with purpose (conversion rates are up), buying when they have a real or perceived need, and visiting the mall less for entertainment value. - Off-Price Well Positioned With Generation Y For Long-Term Secular Wins; Teens Are Increasingly Shopping Online and On Their Phones

Over the past 13 years, we’ve truly witnessed two major shifts in shopping channel preferences and behaviors. First, the shift to off-price retailing is very real and not anchored simply in also-ran overstocks from the department store crowds. These teens almost equally prefer off-price venues to traditional department stores for their fashion needs. Second, teens are increasingly shopping online and on their phones. That said, brick-and-mortar stores should not lose heart in that when asked about preferences between shopping in store and online, about three-quarters of the females we polled prefer stores over sites, but the males are closer to a fifty-fifty split. Moreover, when we ask about preferences between pure play e-commerce sites and sites associated with stores when shopping for clothing, we continue to find that only 14% of females and 24% of males prefer the pure play e-commerce sites. This does, however, indicate to us that brick-and-mortar retailers need to continue to invest in their sites and create frictionless shopping experiences in order to maintain this top-of-mind status among teens. Key to this strategy, we believe, is wrapped up in a mobile strategy. - Households Digest Tax Changes; Parent Contribution Returns; Unemployment Elevated

Parent contribution bounced back to the 65% of spend range, which aligns with historical precedent, following a period of contraction as households digested the early-2013 payroll tax change and delayed refund checks. Teen unemployment remains elevated, but off of peak levels. Time priorities have shifted over time – advanced placement (AP) courses are the norm, year-round single sport/activities are more common, and school years are starting earlier and ending later (shortening the opportune summer employment period). - Influence of Friends and Internet Combine in Social Media Environments

Influences remain consistent with friends dominating both upper income and average income followed by the internet. The Internet first displaced television as the No. 2 influencer with teens in our Fall 2010 survey, and we believe this uptrend will likely continue as social networking and online shopping drive teens online. Instagram and Twitter are the two most used social media sites – teens are increasingly visual and sound bite communicators. - Different is the New Cool; Mindshare Dispersed Across Multiple Brands and Lifestyles

Multi-branded retail (action sports, fashion athletic and performance athletic) is increasingly preferred to single brand (vertical) retailing. And teens are graduating up the brand curve a lot faster – seeking common shopping experiences but different transaction composition. Individuality and “different” are the new cool. - Consistent Group of Clothing Brands Preferred But Rank and Share Shifted

Across both our upper income and average income sub-sets, the top five preferred clothing brands were consistent to the prior year and prior season, but rank and share shifted slightly. In our upper income group (teens that tend to be trend leaders), Action Sports Brands ceded share as Forever 21 gained share. This may be due to greater geographic representation from the East versus the West in our results. Within Action Sports Brands, teens listed 29 unique lifestyle brands. This is evidence of extended boundaries around the core lifestyle aesthetic into areas of streetwear, urban and culturally inspired trends. - Key Fashion Trends: Spirit of Choice – Action Sports, Fast Fashion, Refined Classics, Fashion Athletic

Survey results point to four distinct fashion themes: stability in demand for Action Sports Brand demand; moderation in Fast Fashion preference among teen girls; cresting of the refined classic cycle, and evolving demand for fashion athletic brands. In addition to these trends, an increasingly active teen is catering to growing demand for performance athletic brands.

The Taking Stock With Teens survey is a semi-annual research project comprised of gathering input from approximately 7,500 teens with an average age of 16.4 years. Teen spending patterns, fashion trends, and brand and media preferences were assessed through visits to a geographically diverse subset of high schools across 12 states, 14 schools and 18 classrooms, as well as an online survey that included 48 states. The survey is conducted in partnership with DECA, an international association of high school students. The spring survey was conducted from February 24 – April 1, 2014.