With its stock at its highest point since March 2014, Saga Communications is a shining star among publicly traded broadcast media companies. Therefore, its upcoming annual shareholders meeting could be filled with positive vibes.

The stockholders’ annual meeting will be held at the company’s corporate offices, located at 73 Kercheval Ave. in Grosse Pointe Farms, Mich., on Monday, May 8 at 9am.

The key objectives of the meeting are to elect directors for the ensuing year and until their successors are elected and qualified; to ratify the appointment of UHY LLP to serve as its independent registered public accounting firm for the fiscal year ending Dec. 31, 2017; to adopt, by a non-binding advisory vote, a resolution approving the compensation of Saga’s named executive officers; to recommend, by a non-binding advisory vote, whether the non-binding advisory vote to approve the compensation of our named executive officers should occur every year, every other year, or every three years; and to transact such other business as may properly come before the annual meeting or any adjournment thereof.

Stockholders of record on March 28 may participate in the meeting, either by proxy or in person.

As of March 28, 2017, Saga had outstanding and entitled to vote 5,017,094 shares of Class A Common Stock and 878,475 shares of Class B Common Stock.

TowerView LLC, led by General Partner and President Danny Tisch, owns 24% of Saga’s Class A shares, numbering 1,204,141 total shares. T. Rowe Price & Associates has 14.8% ownership of Saga’s Class A shares, while Royce & Associates LP possesses 12.9% of the company’s Class A stock.

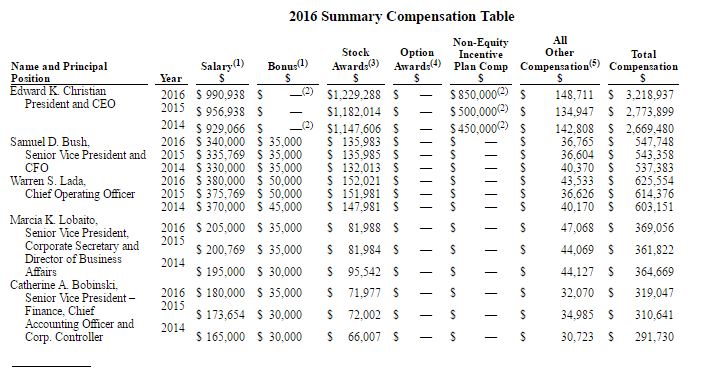

(1) Includes amounts deferred under the Company’s 401(k) Plan, the 2005 deferred compensation plan, and the CEO’s amended 2011 employment agreement. Under the 401(k) Plan, all of the matching funds were used to purchase 20, 24, and 23 shares of Class A Common Stock in 2016, 2015, and 2014, respectively, for each named executive officer.

(2) The entire bonus awarded to Mr. Christian in 2016, 2015 and 2014 was based on his having satisfied the BCF performance goals. The amount of such bonus is disclosed under the column entitled “Non-Equity Incentive Plan Comp.”

(3) Includes restricted stock awarded on November 28, 2016, November 13, 2015, and December 4, 2014, respectively. See “Long Term Incentives” under “Compensation Discussion and Analysis” above.

(4) No options were awarded in 2016, 2015 or 2014.

(5) With respect to Mr. Christian, perquisites include personal use of Company provided automobile, country club dues, medical expense reimbursement, participation in an executive medical plan, personal tax consulting and tax return preparation fees, and personal use of a private airplane in 2016, 2015 and 2014. In 2016, 2015 and 2014 the personal use of the private airplane for Mr. Christian was in the amounts of $31,350, $16,865 and $33,065, respectively (computed using the actual invoice cost incurred by the Company). In 2016, 2015 and 2014, Mr. Lada received perquisites for personal use of a Company provided automobile and medical expense reimbursements. In 2016 Mr. Lada received perquisites for a housing accommodation. In 2016, 2015 and 2014, Mr. Bush, Ms. Lobaito and Ms. Bobinski received perquisites for personal use of Company provided automobile, housing accommodation and medical expense reimbursements. Perquisites are valued based on the aggregate incremental costs to the Company. In addition, in each of 2016, 2015 and 2014, the Company paid life insurance (including split dollar) premiums for Mr. Christian, Mr. Bush, Mr. Lada, Ms. Lobaito and Ms. Bobinski in the amounts of $51,806, $11,806, $11,806, $11,393, and $11,264, respectively, and long-term care insurance premiums for Mr. Christian, Mr. Bush, Mr. Lada, Ms. Lobaito and Ms. Bobinski in the amounts of $21,290, $12,694, $13,846, $17,518, and $11,974, respectively.