That’s a question CapitalCube sought to answer, and in a Tuesday (4/11) analysis compared Beasley Broadcast Group‘s dividend to no less than eight radio broadcasting companies with publicly traded stock.

Beasley’s dividend was put to the test against the Class D shares of Radio One and the Class A shares for Emmis Communications, Entercom Communications, Entravision Communications, Saga Communications, Salem Media Group, and beleaguered media company Spanish Broadcasting System (SBS).

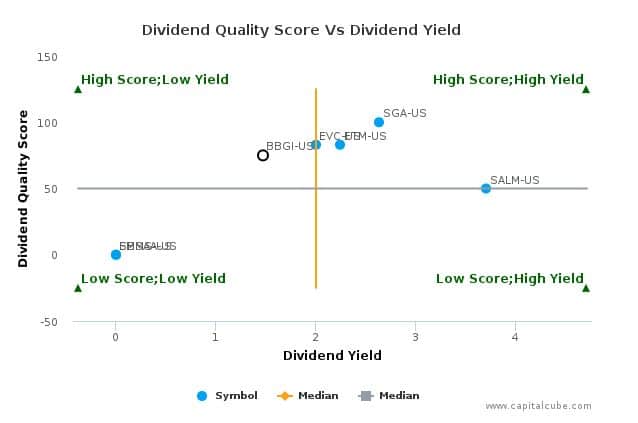

Beasley’s dividend yield is 1.47%. Additionally, its dividend payout is 9.09%. This compares to a peer average dividend yield of 2% and a payout level of 24.73%.

“This relatively lagging dividend performance could spur some dividend action going forward,” CapitalCube says, with a caveat. In its view, future dividend action will only come if Beasley’s “relatively strong” dividend quality score of 75 out of a possible score of 100 looks sustainable.

During the calendar year of 2016, Beasley paid a medium quality dividend, which represents a yield of 1.47% at the current price, CapitalCube notes.

This means that its dividend quality trend has not been consistent over the last five years. “Dividends were paid during four of these years,” it notes. “Of these three were high quality and one was medium quality.”

Yet, the ending cash balance, with a dividend coverage of 4.91x, “provides a substantial cushion in case of a significant reduction of cash flows in the future.”

The source of Beasley’s cash to support the dividend paid over 2016 is operating cash flow (coverage of 4.14x), investing cash flow (coverage of -21.64x), issuance cash flow (coverage of 19.95x) and twelve-month prior cash (coverage of 3.46x), for a total dividend coverage of 5.91x, CapitalCube notes.

The company‘s issuance cash flow includes outflows from net share buybacks (coverage of -0.05x). Thus, the total coverage including share buybacks is 5.96x.

This reflects CapitalCube‘s assumption that the cash paid for share buybacks is discretionary and could instead be used to pay dividends.