We have long argued against the risks towards agencies that are associated with the rise of technology in general and the web in particular. More to point, we have argued that agencies are net beneficiaries of the inherent complexity associated with managing the increasingly fragmented media and marketing choices available to marketers. Despite those who have argued that agencies are dinosaurs, slow to adapt and due for extinction at the hands of disintermediators, our view is that over the very long term agencies should even out-perform most media owners who, despite producing often-valuable and scarce content, will never have the ability to do the distinct work that agencies perform. Whether at a creative agency, a media agency, a CRM agency or any other function within the holding companies, the task of socializing ideas with marketers’ various constituents (many of whom need to sign off on marketing choices) across global enterprises is challenging work at the best of times. And as marketers’ global enterprises also become more complex, agencies become even more essential.

We have long argued against the risks towards agencies that are associated with the rise of technology in general and the web in particular. More to point, we have argued that agencies are net beneficiaries of the inherent complexity associated with managing the increasingly fragmented media and marketing choices available to marketers. Despite those who have argued that agencies are dinosaurs, slow to adapt and due for extinction at the hands of disintermediators, our view is that over the very long term agencies should even out-perform most media owners who, despite producing often-valuable and scarce content, will never have the ability to do the distinct work that agencies perform. Whether at a creative agency, a media agency, a CRM agency or any other function within the holding companies, the task of socializing ideas with marketers’ various constituents (many of whom need to sign off on marketing choices) across global enterprises is challenging work at the best of times. And as marketers’ global enterprises also become more complex, agencies become even more essential.

Dinosaurs? No, we are much more inclined towards the notion articulated by Publicis’ Rishad Tobaccowala when he stated in 2012 that agencies “are cockroaches”, capable of surviving as giants lumber around them. This is actually meant in a positive light: evolutionarily speaking, the cockroach can be regarded as a highly successful species, having outlasted so many others with no signs of decline.

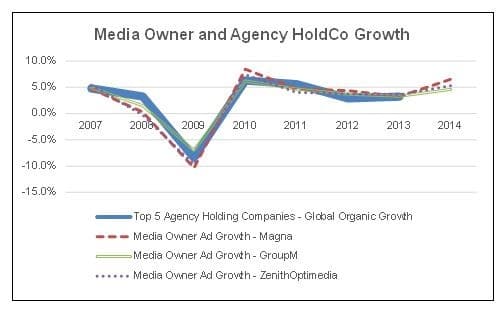

So as we look towards our outlook for agencies in 2014, we wanted to review recent trends around agency holding companies’ organic growth rates relative to the media owners whose activities are widely viewed as proxies for the agencies. In our view, the underlying need for agencies may have accelerated over the past decade, and especially post-2007 as digital media really began to take off among the marketers that agencies tend to work with. This may have been offset by a commensurate expansion in the presence of procurement in marketing, which probably has constrained agency growth to some degree. However, the general picture remains the same even if we look back as far as the dawn of the millennium. Indexed against global media spending, the top five global agency holding companies have grown in-line with global media owner growth, occasionally exceeding and sometimes falling slightly below this benchmark.

Source: Pivotal Research analysis of company reports, Magna Global, GroupM, ZenithOptimedia

Thus, it should be notable that the three leading forecasters of global advertising trends, at Interpublic’s Magna Global, at WPP’s GroupM and at Publicis’ ZenithOptimedia all forecast a notable expansion of advertising in 2014, even if off a tepid 2013 base. Magna’s forecast calls for a 330bps expansion, while GroupM’s amount’s to 130bps and Zenith forecasts 170bps. The average of these three forecasts amounts to a better than 2% expansion of the growth rate experienced during 2013. Such an acceleration would be notable for both media owners and agencies alike, as the only other years since 2001 to meet or exceed this level were in 2004 and 2010. However, they do seem realistic given what appears to be a stabilizing global economy in 2014, in contrast to the highly uncertain one experienced over the past few years.

2013 will probably be a year where the agencies grow by slightly more than 3% organically. From that base, whether or not the global agency holding companies can actually expand during 2014 by a further 5% on an organic basis, on average, remains to be seen. However, such levels would be reasonable so long as economic stability continues.

Over the very long-run agencies have the potential to perform better than media because of marketers’ increasing reliance on un-paid media and the role that agencies have in performing related work. Some sectors such as digital media and TV probably grow faster, but all others (print, radio, outdoor, etc) will probably grow at a much slower pace. Of course, this is partially offset by those very marketers asking their agencies to do more with less, but such trends have been in place for many years, and yet agency holding companies have held up well. By contrast, marketers’ increasing reliance on targeting and retargeting their existing customers places marketers in a position of relative advantage as they increasingly gain and exercise the capacity to shift their spending away from context-driven media that media owners can exercise pricing power over. This is why, for the most part, we have generally taken a more negative view on the very long-run for most ad-supported media, at least on a relative basis.

To our view, the real dinosaurs of the media industry have been print media, and legacy “premium” publishers of digital media are not far away by comparison. There are certainly going to be large, incumbent survivors as media continues to evolve, such as owners of media properties focused on television or those digital-centric entities with dominant scale, such as with Google and Facebook, or with substantial differentiation, such as with Twitter. But in the event there ever was the equivalent of a nuclear winter that attempted to render most of the advertising industry as mostly extinct, nature would suggest that it would be the agencies who would continue to survive and thrive.

–Brian Wieser, CFA

Senior Research Analyst

Pivotal Research Group